Health Insurance and Medical Systems Abroad: What Sri Lankans Must Understand

Imagine landing your dream job in Dubai, London, or Australia—exciting, right? But what happens when a sudden illness strikes far from home, and you're faced with eye-watering medical bills? For us Sr...

Imagine landing your dream job in Dubai, London, or Australia—exciting, right? But what happens when a sudden illness strikes far from home, and you're faced with eye-watering medical bills? For us Sri Lankans heading abroad for work or study, understanding health insurance and foreign medical systems isn't just smart—it's essential to protect your hard-earned savings and peace of mind.

In 2026, with more of our locals grabbing overseas opportunities in places like the Middle East and Europe, getting this right can make all the difference.Health insurance abroad differs wildly from our familiar public system here, where consultations cost as little as 1500-3000 LKR.[1] Private care overseas? Think tens of thousands in pounds or dollars. Let's break it down so you can step confidently into your international career.

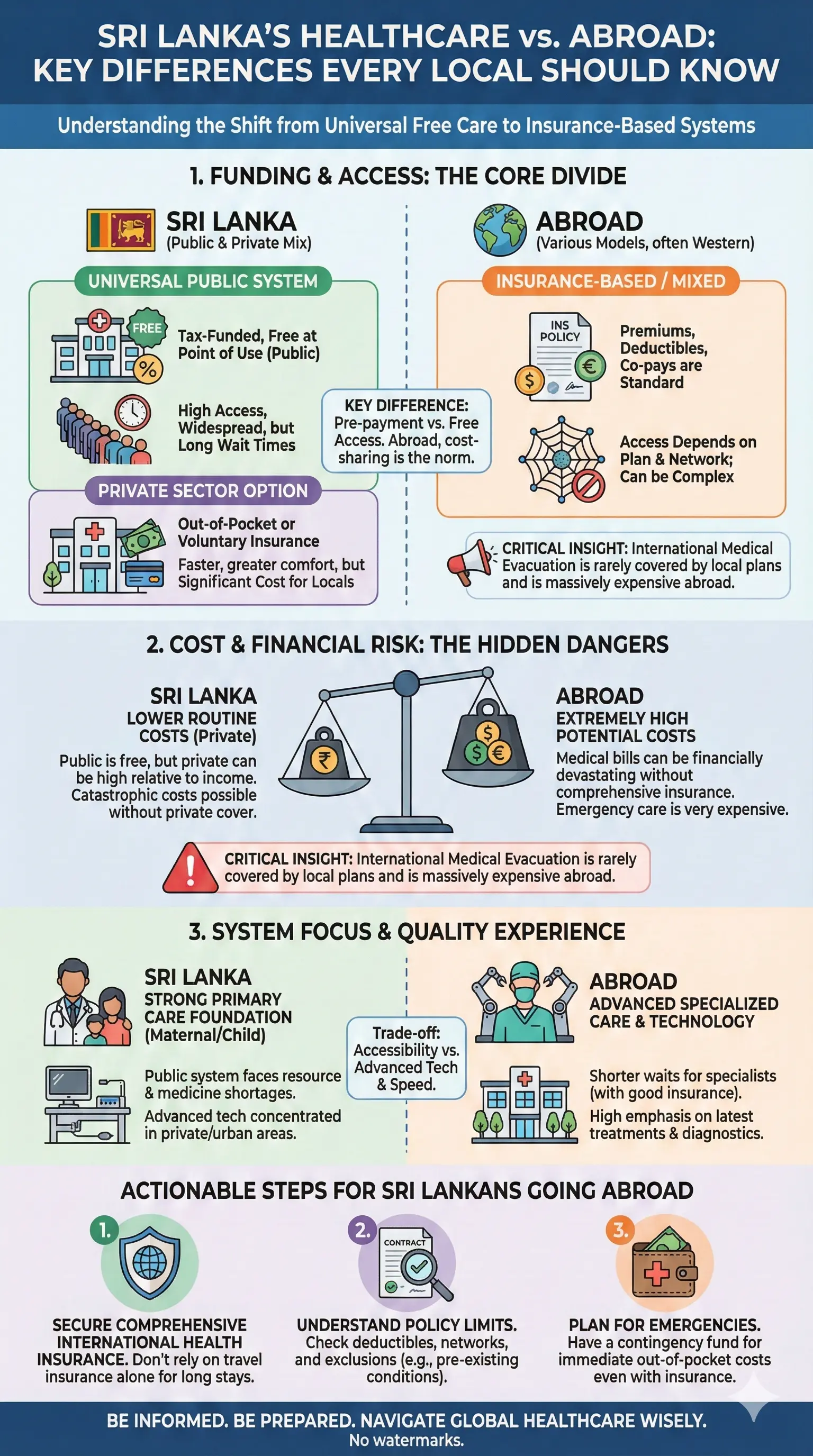

Sri Lanka's Healthcare vs. Abroad: Key Differences Every Local Should Know

Our island's healthcare shines in the public sector—free or low-cost for citizens—but expats and non-residents pay premium private rates.[1] Abroad, systems vary: the UK's NHS offers free care to residents after registration, but newcomers face waits and gaps. In the US, without insurance, a simple ER visit can hit $2000+ (over 600,000 LKR).

Public vs. Private: What Changes When You Leave Sri Lanka

- UK/Europe: Public systems like NHS require residency proof and NI numbers; tourists/ new workers pay full whack unless insured.

- Middle East (UAE, Qatar): Mandatory employer-provided insurance for workers, but it often caps at basic coverage—supplement with personal plans for families.[2]

- Australia/Canada: Overseas Visitor Health Cover (OVHC) is required for visas; public Medicare kicks in later for permanent residents.

Pro tip: Before your ETA or work visa, check Immigration Department guidelines at immigration.gov.lk. No Sri Lankan law mandates overseas insurance, but it's wiser than facing bills that drain your remittance money.[3]

Why Employer Coverage Alone Won't Cut It for Sri Lankans Abroad

Many jobs in construction, nursing, or IT promise "health insurance," but read the fine print. Group plans often hit low ceilings fast—think 60,000 USD max for emergencies, with excesses like 100 USD.[7] Lose your job? Coverage vanishes overnight, leaving gaps during job hunts.[1]

Common Pitfalls We've Seen Locals Face

- Limited Portability: Tied to your sponsor; switch employers, and you're uninsured amid waiting periods.

- Exclusions Galore: No dental, maternity, or chronic care like dengue follow-ups—vital if you're from tropical Sri Lanka.[4]

- Ceilings Too Low: Hospital nights abroad? 20,000-50,000 LKR here balloons to thousands abroad.[1]

Actionable advice: Always get a personal international plan. Providers like Cigna Global, Allianz, or AXA offer portable coverage worldwide, perfect for our roaming workforce.[2][6]

International Health Insurance vs. Travel Insurance: Don't Mix Them Up

Travel insurance suits short beach holidays (no Sri Lanka entry mandate in 2026[3][5]), covering emergencies and evacuations up to 60,000 USD.[7] But for career moves? Go international health insurance—it's for long-term stays, routine check-ups, and full family protection.[1]

| Type | Best For | Covers | Sri Lankan Example |

|---|---|---|---|

| Travel Insurance | 2-week UK job interview | Emergencies, evacuation | Dengue in Colombo holiday—covered[4] |

| International Health | 2-year Dubai contract | Routine, maternity, chronic | Appendicitis surgery: 200,000-500,000 LKR fully billed[1] |

Check gaps: Home policies exclude abroad treatment; credit cards cap low.[4] Quiz your provider: "Does it cover hospitalization abroad? Tropical diseases? Evac max?"

How to Choose the Right Health Insurance Plan Abroad

With 100+ options, focus on these 5 criteria tailored for us:[1]

1. Local-Relevant Benefits

Cover specialists, meds, private hospitals—add maternity if family's joining.

2. Direct Billing Networks

No upfront cash: Partnered clinics in Colombo, Dubai, or London bill insurers directly.[1]

3. 24/7 Assistance in Sinhala/English

Crucial for emergencies; brokers like Alea offer dedicated support.[1]

4. Fast Claims & Portability

Online submissions, quick reimbursements—worldwide coverage follows you home.

5. Trusted Providers for Expats

- Cigna Global & Allianz: Top for Sri Lankans abroad[2]

- MSH International, GeoBlue, AXA: Comprehensive plans[6]

- SriLankan Airlines option for starters: 60k USD medical[7]

Cost? A solid plan: 40-80 USD/month per person—cheaper than one hospital night abroad.

Sri Lanka-Specific Tips: Preparing Before You Go

Visit Nawaloka or Asiri for pre-departure checks—get records digitized. Register with the Sri Lankan Embassy abroad via lankaembassy.org for consular help. For OFWs in Gulf, check SLBFE (Sri Lanka Bureau of Foreign Employment) for approved insurers: slbfe.lk.

2026 update: No visa insurance mandates for most spots, but UAE/Qatar require it—fine or deportation risks.[10]

FAQ

Is health insurance mandatory for working abroad?

No universal rule, but UAE/Qatar demand employer proof. Always get personal coverage—employer plans lapse.[2]

What if dengue flares up abroad?

International plans cover it; travel ones might deny if not "emergency." Confirm tropical inclusions.[4]

How much evacuation costs without insurance?

Colombo to Colombo (home) air ambulance: 100,000+ USD. Policies cap at 50k? Gap alert![4]

Can I use Sri Lankan public hospitals abroad? No—get private international.

Foreign systems limit non-residents; private networks ensure quality care.[1]

Best for families moving to Australia?

OVHC-compliant plans like Allianz—covers till Medicare eligibility.[2]

Switching jobs abroad?

Portable international insurance bridges gaps—no waiting periods on pre-existing if declared.

Next Steps: Secure Your Coverage Today

Don't leave it to chance—compare quotes from Cigna, Allianz, or brokers today. Use SLBFE resources for vetted options, pack your policy docs, and share details with family back home. Your overseas adventure awaits, but with solid health insurance, you'll thrive without the worry. Start by checking slbfe.lk or immigration.gov.lk, then get personalized quotes—it's quick and could save lakhs.

Sources & References

- Expat Health Insurance in Sri Lanka | Complete Guide - Alea — alea.care

- A Guide to the Sri Lanka Healthcare System for Expats — expatfinancial.com

- Sri Lanka Travel Insurance - Travel Medical Insurance for Tourists — insubuy.com

- Sri Lanka travel insurance gap: Why your policy might not cover — airtraveler.club

- Sri Lanka Travel Insurance - Quote, Compare & Buy — insuremytrip.com

- Best International Health Insurance Plans for Expats in Sri Lanka — pacificprime.com

- Travel Insurance — SriLankan Airlines — srilankan.com

- Travel advice and advisories for Sri Lanka — travel.gc.ca

- Best Nomad Insurance for Sri Lanka 2026 — nomadwise.io

- Travel Insurance — VFS Global — vfsglobal.com

Related Articles

Is the Migration Dream Fading? A Reality Check for Sri Lankans Planning to Leave

The dream of working abroad has long been a beacon of hope for many Sri Lankans seeking better opportunities and financial security. Yet as we enter 2026, it's worth asking: is this dream still as gol...

Skilled Migrant Category in New Zealand for Sri Lankans: Step-by-Step

If you're a skilled professional from Sri Lanka considering a move to New Zealand, the Skilled Migrant Category (SMC) Resident Visa could be your pathway to permanent residence. With significant chang...

Top 10 Mistakes Sri Lankans Make Before Going Abroad (That Cost Them Lakhs)

Dreaming of working abroad? Many Sri Lankans lose lakhs of rupees and face visa rejections because they make preventable mistakes before they even apply. From inflating qualifications to submitting fo...

Study in Australia from Sri Lanka: Visa, Costs, and PR After Graduation

Dreaming of studying in Australia while building a path to permanent residency? For Sri Lankan students, 2026 brings exciting opportunities in world-class universities, but with updated visa rules tha...