Best Credit Cards for 2026

Are you tired of using a credit card that doesn't quite meet your needs? You're not alone. With so many options available, it can be overwhelming to choose the right one. But what if you could find a credit card that offers the perfect combination of rewards, benefits, and terms? I think it's time...

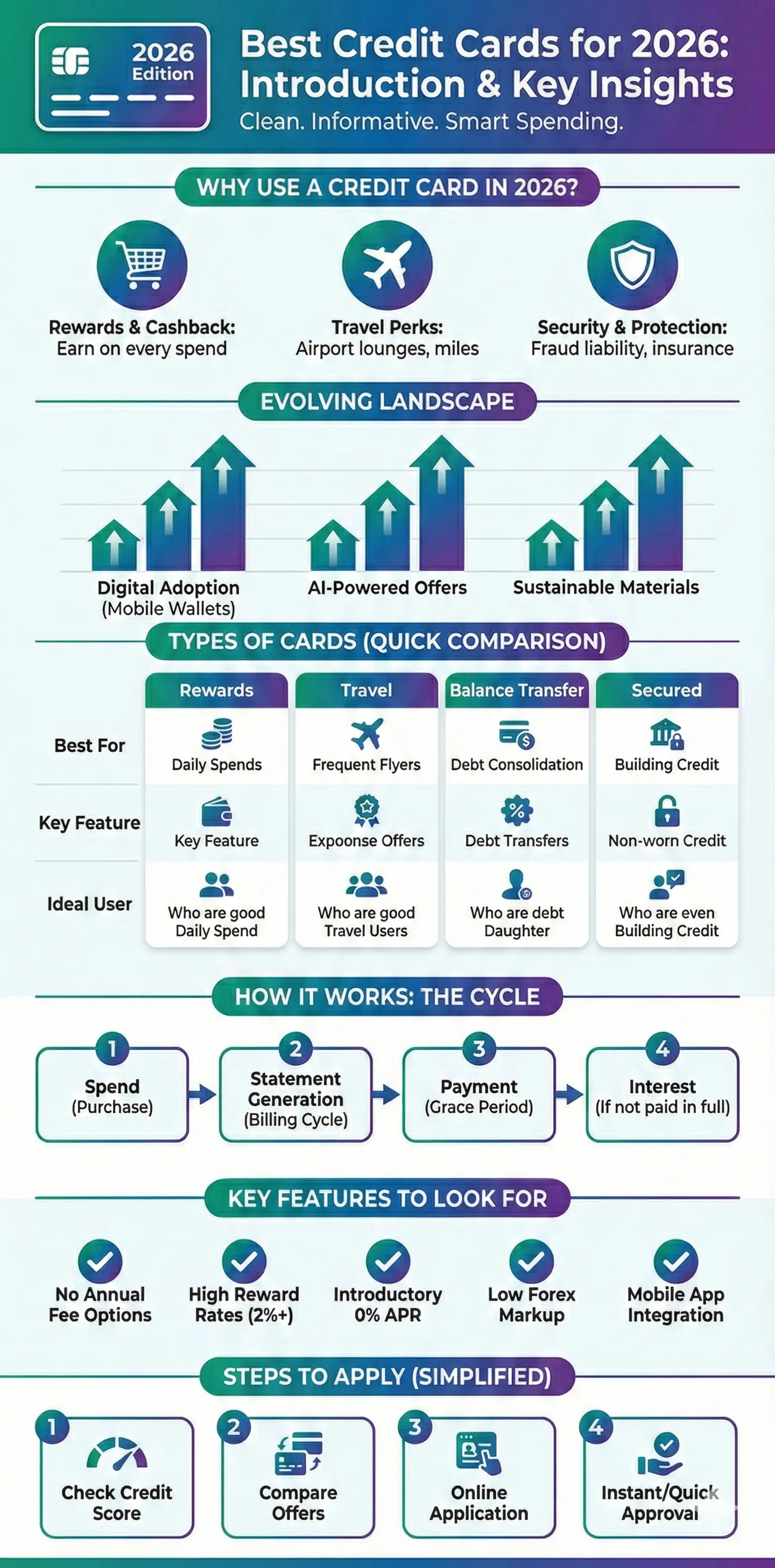

Are you tired of using a credit card that doesn't quite meet your needs? You're not alone. With so many options available, it can be overwhelming to choose the right one. But what if you could find a credit card that offers the perfect combination of rewards, benefits, and terms? I think it's time to take a closer look at your credit card options and find the one that's right for you. In this article, I'll share my expertise on the best credit cards for 2026, covering everything from cashback and travel rewards to building credit and making the most of your card.

As someone who's spent years researching and comparing credit cards, I'm excited to share my knowledge with you. Whether you're looking to earn cashback on your daily purchases, travel the world in style, or build your credit from scratch, I've got you covered. So, let's get started and explore the world of credit cards together. By the end of this article, you'll be equipped with the knowledge to make an informed decision and find the perfect credit card for your unique needs and goals.

Introduction to Credit Cards

Credit cards come in all shapes and sizes, each with its own unique features and benefits. I think it's essential to understand the different types of credit cards available before making a decision. You've got your cashback credit cards, which offer a percentage of your purchases back as a reward. Then there are travel credit cards, which provide points or miles that can be redeemed for flights, hotels, and other travel expenses. And let's not forget about secured credit cards, which are designed for individuals with poor or limited credit history.

But how do credit cards affect your credit score? I think it's crucial to understand that credit cards can either help or hurt your credit score, depending on how you use them. Making on-time payments and keeping your credit utilization ratio low can help improve your credit score over time. On the other hand, missing payments or maxing out your credit limit can have a negative impact. According to a recent study, individuals who use less than 30% of their available credit tend to have higher credit scores than those who use more. For example, if you have a credit limit of $1,000, try to keep your balance below $300 to avoid negatively affecting your credit score.

It's also worth noting that credit cards often come with fees and interest rates that can add up quickly. I think it's essential to read the fine print and understand the terms and conditions of your credit card before applying. Some credit cards may offer 0% introductory APRs, while others may charge high interest rates or annual fees. By understanding the fees and terms associated with your credit card, you can make informed decisions and avoid costly mistakes.

Top Cashback Credit Cards

Cashback credit cards are a popular choice among consumers, and for good reason. I think they offer a simple and rewarding way to earn money back on your purchases. Some of the top cashback credit cards for 2026 include the Citi Double Cash Card, which offers 2% cashback on all purchases, and the Chase Freedom Unlimited, which provides 3% cashback on all purchases in your first year up to $20,000 spent. These cards often come with no annual fee and no rotating categories, making them a great choice for everyday use.

However, it's essential to consider the fees and limitations associated with cashback credit cards. I think it's crucial to read the fine print and understand the terms and conditions before applying. For example, some cashback credit cards may have foreign transaction fees, which can add up quickly if you travel abroad. Others may have limited redemption options, which can make it difficult to redeem your rewards. By understanding the fees and limitations, you can make informed decisions and choose the best cashback credit card for your needs.

For instance, the Discover it Cash Back offers 5% cashback on various categories throughout the year, such as gas stations, grocery stores, and restaurants. However, the categories change quarterly, and you must activate the bonus categories each quarter to earn the 5% cashback. By understanding the terms and conditions, you can maximize your rewards and earn more cashback on your purchases.

Best Travel Credit Cards

Travel credit cards are perfect for individuals who love to explore new destinations. I think they offer a range of benefits, from travel rewards to airport lounge access. Some of the top travel credit cards for 2026 include the Chase Sapphire Preferred, which offers 2X points on travel and dining purchases, and the Capital One Venture, which provides 2X miles on all purchases. These cards often come with travel insurance, trip cancellation insurance, and other perks that can make your travels more enjoyable and stress-free.

One of the most significant benefits of travel credit cards is the ability to earn travel rewards. I think it's essential to understand how to redeem your rewards and make the most of your card. For example, the Chase Sapphire Preferred offers 25% more value when you redeem your points for travel through the Chase portal. This means that if you have 50,000 points, you can redeem them for $625 in travel credit. By understanding the redemption options, you can maximize your rewards and enjoy more travel benefits.

Additionally, many travel credit cards offer airport lounge access, which can be a game-changer for frequent travelers. I think it's worth considering the benefits of lounge access, from complimentary food and drinks to comfortable seating and Wi-Fi. For instance, the Citi Prestige offers access to over 1,000 airport lounges worldwide, including Priority Pass lounges. By having lounge access, you can make your travels more comfortable and enjoyable, even when you're not flying first class.

Credit Cards for Building Credit

Credit cards can be a powerful tool for building credit, but I think it's essential to choose the right one. Secured credit cards are a great option for individuals with poor or limited credit history. These cards require a security deposit, which becomes your credit limit, and often come with lower fees and interest rates than unsecured credit cards. Some of the top secured credit cards for 2026 include the Discover it Secured and the Capital One Secured Mastercard.

When choosing a credit card for building credit, I think it's crucial to consider the credit limit and how it will affect your credit utilization ratio. A higher credit limit can be beneficial, but it can also be tempting to overspend and accumulate debt. For example, if you have a credit limit of $500, try to keep your balance below $150 to avoid negatively affecting your credit score. By keeping your credit utilization ratio low, you can demonstrate responsible credit behavior and improve your credit score over time.

It's also worth noting that credit cards for building credit often come with fewer benefits and rewards than other credit cards. I think it's essential to understand that these cards are designed to help you establish or rebuild your credit, rather than provide luxurious perks. However, some secured credit cards may offer rewards or benefits, such as the Discover it Secured, which offers 1% cashback on all purchases. By understanding the terms and conditions, you can make informed decisions and choose the best credit card for building your credit.

How to Choose the Best Credit Card

With so many credit cards available, I think it can be overwhelming to choose the right one. But by considering your individual needs and goals, you can make an informed decision and find the perfect credit card for you. First, I think it's essential to determine what you want to get out of your credit card. Are you looking to earn cashback on your purchases, or do you want to accumulate travel rewards? Perhaps you're trying to build your credit or pay off debt.

Once you've determined your goals, I think it's crucial to compare different credit cards and their features. You can use online tools and resources to compare credit cards side by side, considering factors such as interest rates, fees, and rewards. For example, you can use websites like NerdWallet or CreditCards.com to compare credit cards and find the best one for your needs. By understanding the terms and conditions of each credit card, you can make informed decisions and choose the best card for your unique situation.

When applying for a credit card, I think it's essential to consider the application process and what you'll need to provide. Most credit card applications require basic personal and financial information, such as your name, address, and income. You may also need to provide employment information or other details to verify your identity and creditworthiness. By understanding the application process, you can prepare ahead of time and increase your chances of approval.

Key Takeaways

Choosing the right credit card can be a daunting task, but I think it's essential to take the time to research and compare different options. By understanding the different types of credit cards, their features, and their benefits, you can make an informed decision and find the perfect card for your unique needs and goals. So, what's the best credit card for you? I think it's time to take a closer look at your options and find the one that will help you achieve your financial goals. Will you start by exploring cashback credit cards, or perhaps travel credit cards? Whatever your choice, I'm confident that you'll find the perfect credit card to suit your lifestyle and preferences.

Frequently Asked Questions

Related Articles

How to Negotiate Credit Card Debt

Did you know that over 40% of Americans carry credit card debt from month to month? This staggering statistic is a sobering reminder that managing credit card debt is a challenge many of us face. I've seen it firsthand - a friend of mine was struggling to pay off a balance of over $10,000, with int...

How to Invest in Real Estate

<img src='https://www.lankawebsites.com/wp-content/uploads/2026/01/pixabay-real-estate-investment-growth-7b649-1024x590.webp' alt='real estate investment growth graph' loading='lazy' />...

How to Analyze Stocks for Beginners

If you're thinking about investing in stocks but don't know where to start, you're not alone. Many Sri Lankan investors feel overwhelmed by market jargon, complex charts, and endless investment options.

Best Retirement Accounts for Self-Employed

If you're self-employed in Sri Lanka, you're responsible for your own retirement planning—and that's both a challenge and an opportunity.