External Commercial Borrowings Guide for Sri Lankan Firms in 2026

Struggling to fund your Sri Lankan business's next big expansion? External Commercial Borrowings (ECB) could be the lifeline you've been waiting for, especially as the Central Bank eases restrictions...

Struggling to fund your Sri Lankan business's next big expansion? External Commercial Borrowings (ECB) could be the lifeline you've been waiting for, especially as the Central Bank eases restrictions in 2026.ECB Sri Lanka offers firms access to cheaper foreign capital, but navigating the rules is key to avoiding pitfalls. We'll break it down step-by-step so you can tap into commercial borrowings compliantly and confidently.

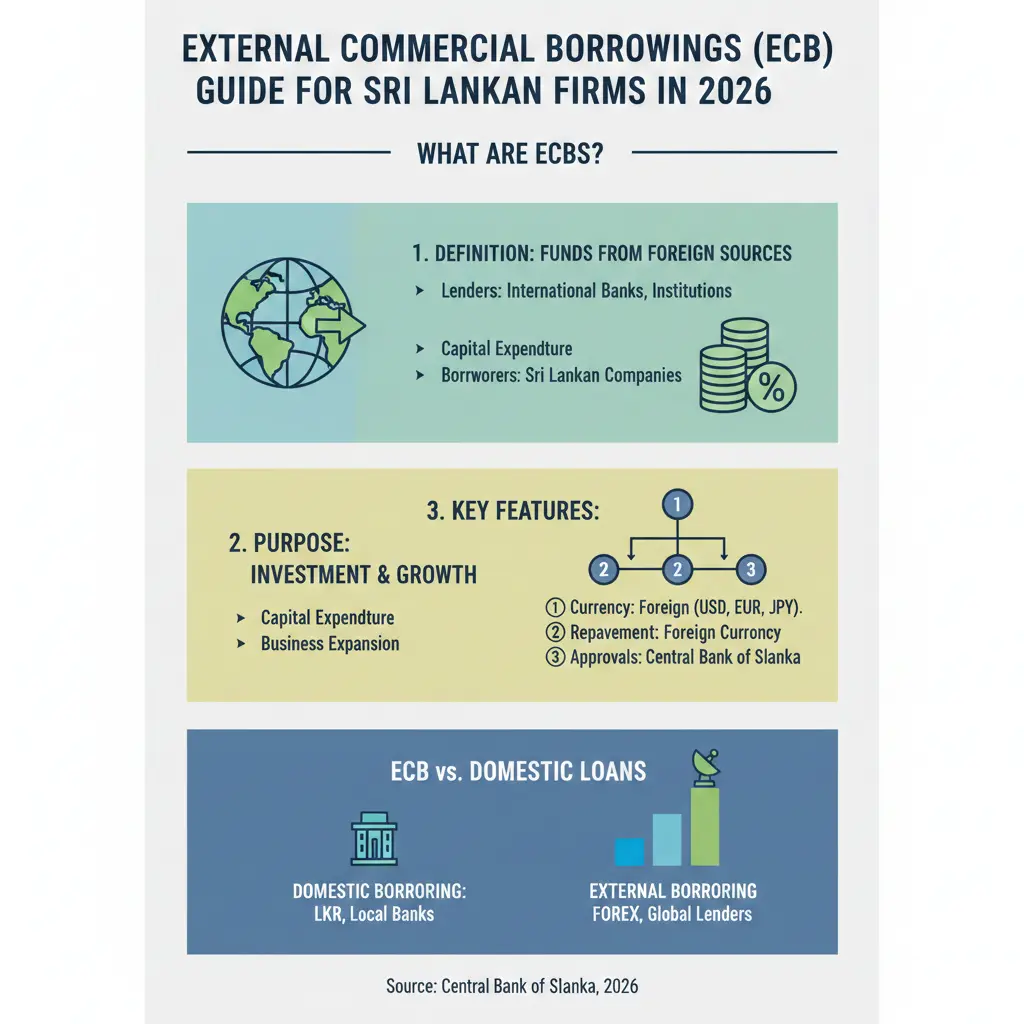

What Are External Commercial Borrowings (ECB)?

External Commercial Borrowings let Sri Lankan companies borrow funds from non-resident lenders in foreign currency, typically for capital-intensive projects like manufacturing upgrades or tech imports. Unlike domestic loans, ECB often come at lower interest rates due to global competition, making them attractive for firms facing high local borrowing costs.

In Sri Lanka's context, ECB have evolved from government-led issuances to private sector tools. The External Resources Department (ERD) pioneered this with sovereign bonds since 2007, paving the way for private firms.[2] Today, with reserves strengthening, the Central Bank is reviewing frameworks to make ECB Sri Lanka more accessible.[1]

ECB vs Other Funding Options

- Domestic Bank Loans: Higher interest (often 10-15%), rupee-denominated, easier approval but inflation-exposed.

- Equity FDI: No repayment but dilutes ownership; slower approvals via Board of Investment (BOI).

- ECB: Cheaper (LIBOR + 2-3%), foreign currency, but requires Central Bank nod and forex hedging.

For a Colombo exporter like a garment factory, ECB might fund machinery imports at 6% versus 12% locally, boosting competitiveness.[1]

Current ECB Regulations for Sri Lankan Firms in 2026

The Central Bank of Sri Lanka (CBSL) oversees commercial borrowings under the Foreign Exchange Act. Post-2022 crisis, restrictions tightened, but 2026 brings gradual relaxation. The CBSL's Policy Agenda signals a comprehensive review of ECB rules, aligning them with business needs while strengthening monitoring.[1][3]

Key Eligibility Criteria

To qualify for ECB:

- Minimum Project Size: Typically US$1 million for manufacturing/export sectors; smaller for services via BOI approval.

- End-Use Restrictions: Funds for capital expenditure only—no working capital, real estate, or equity investments.

- Maturity: Minimum 3 years; average tenure around 5-10 years per historical government facilities.[2]

- All-in-Cost Ceiling: Interest + fees not exceeding 500 basis points over 6-month LIBOR/SOFR (around 6-7% in 2026).[2]

Firms must register with CBSL's External Resources Management Division and submit feasibility studies. Non-residents can't lend directly without a licensed bank intermediary.

Approval Process Step-by-Step

- Prepare Application: Submit to CBSL via bank—include lender details, loan terms, project plan, and forex hedging strategy.

- CBSL Review (2-4 weeks): Assesses debt sustainability; no firm-wide debt-to-equity cap but monitors aggregate ECB exposure.[1]

- Disbursement: Funds remit through authorised dealers; report inflows quarterly.

- Repayment: Via forex reserves or exports; grace periods up to 2 years common.

In 2026, expect faster approvals as supervisory systems upgrade, per CBSL's roadmap.[1][3]

Benefits and Risks of ECB for Local Businesses

Why Choose ECB in 2026?

- Cost Savings: Government ECB averaged 5.5-7% interest; private firms can match via strong credit.[2]

- Reserve Boost: Inflows support gross reserves, now stable post-IMF reforms.[1]

- FX Market Innovation: CBSL plans new hedging products, reducing currency risk.[1]

- Sector Growth: Ideal for tourism recovery, apparel exports, or renewable energy amid cyclone reconstruction.[3]

A Kandy tea exporter raised US$10 million ECB in 2025 at LIBOR+2.5%, cutting costs by 40% versus local loans.[2]

Key Risks and Mitigation

ECB expose firms to forex fluctuations—rupee volatility could spike repayments. CBSL mandates hedging; non-compliance risks fines up to LKR 10 million.[1]

| Risk | Impact | Mitigation |

|---|---|---|

| Currency Depreciation | 20-30% rupee drop hikes costs | Forward contracts via banks |

| Refinancing Risk | Global rate hikes | Lock 5+ year tenures |

| Regulatory Changes | Sudden caps | Monitor CBSL circulars |

| Default Penalties | Credit rating hit | Maintain 1.5x DSCR |

How to Apply for ECB: Practical Guide for 2026

Here's your actionable checklist:

Step 1: Assess Readiness

- Check credit score via Commercial Bank of Ceylon or Hatton National Bank.

- Project IRR must exceed all-in ECB cost by 2%.

- Secure lender—Asian Development Bank, EXIM banks, or private funds targeting EMs.

Step 2: Documentation Pack

- Board resolution approving ECB.

- Lender commitment letter.

- Audited financials (last 3 years).

- Legal opinion on compliance.

- Hedging confirmation from bank.

Step 3: Submit and Track

File online via CBSL portal (updated 2026). Expect AEB approval in 21 days for exports; longer for others.[1]

Pro Tip: Partner with BOI-registered status for priority processing—over 300 firms benefited in 2025.

Government Support and 2026 Updates

CBSL's 2026 agenda includes ECB policy assessment alongside FDI rules, with relaxed capital controls since 2020.[1][3] Ministry of Finance's Medium-Term Debt Strategy eyes balanced domestic-external mix post-2026, signaling private ECB green light.[5]

Three new laws by Q1 2026 will de-risk private capital, enhancing investor protections.[6] Plus, Commonwealth Meridian software aids debt tracking, indirectly benefiting corporate borrowers.[4]

"The comprehensive review... will ensure regulations remain aligned with evolving economic conditions and the financing needs of businesses."[1]

Next Steps to Secure Your ECB

Ready to fuel growth? Start by consulting your bank for pre-approval, download CBSL Form 1 from cbsl.gov.lk, and track the Policy Agenda updates. With 2026's reforms, ECB Sri Lanka is more viable than ever—act now to capitalise on low global rates. Contact Lanka Websites for compliant website builds to showcase your funded projects.

Frequently Asked Questions

Sources & References

-

1

Central Bank's Policy Agenda for 2026 and Beyond — www.cbsl.gov.lk

-

2

External Market Borrowings - erd.gov.lk — www.erd.gov.lk

-

3

Central Bank sets 2026 Roadmap for stability and sustainable growth — www.sundaytimes.lk

-

4

Sri Lanka to use Commonwealth debt management software — thecommonwealth.org

-

5

Medium Term Debt Management Strategy - Ministry of Finance — www.treasury.gov.lk

- 6

All sources were accessed and verified as of March 2026. External links open in new tabs.

Related Articles

2026 Sri Lanka Economic Recovery Indicators: Government Targets Explained

Sri Lanka's economy is showing signs of resilience after the devastating 2022 crisis, and 2026 is shaping up to be a crucial year for our nation's recovery. The government and Central Bank have set am...

Sri Lanka Worker Remittances Policy Enhancements: Record $8B in 2025-2026

Sri Lanka's worker remittances have reached unprecedented levels, hitting a record USD 8.076 billion in 2025[1], marking a remarkable 22.8% increase from the previous year. This surge reflects not jus...

World Bank Insights: Optimizing Public Spending Under Sri Lanka's 2026 Fiscal Constraints

As Sri Lankans, we're all feeling the pinch of tighter public budgets in 2026, with the government's fiscal deficit hitting 3.7 trillion rupees while debt servicing eats up 4.5 trillion rupees.Sri Lan...

Foreign Investment Policies in Sri Lanka 2026: Non-Resident Rules, ECB Limits, and How to Navigate

Sri Lanka's economy is on the rise, with foreign direct investment (FDI) already surpassing US$1 billion in 2025 and projections hitting 1.5 to 2 billion USD in 2026.FDI Sri Lanka 2026 looks brighter...