Health and Insurance Checklist for Sri Lankans Going Abroad for Work

Heading overseas for a job opportunity is exciting, but for us Sri Lankans, it's crucial to prioritise our health and financial security. Whether you're off to the Middle East, Australia, or Europe, t...

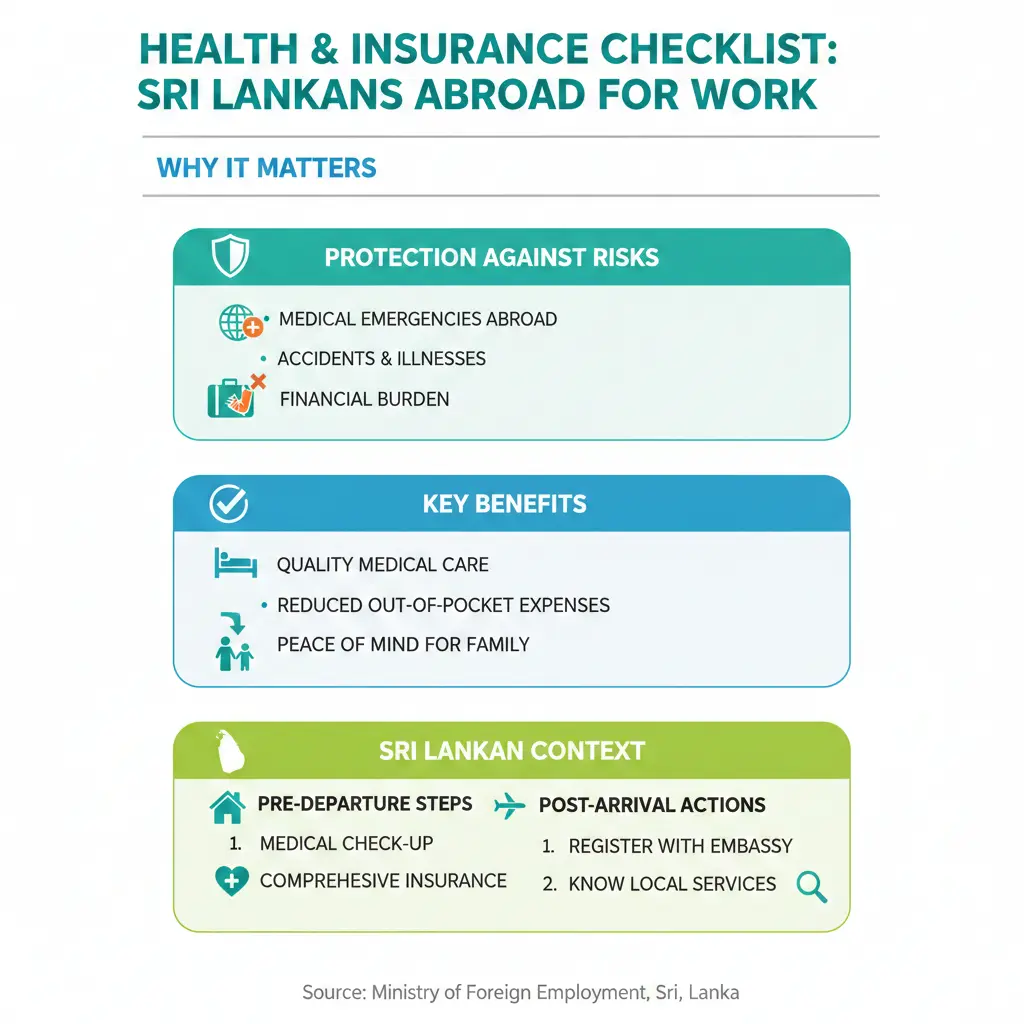

Heading overseas for a job opportunity is exciting, but for us Sri Lankans, it's crucial to prioritise our health and financial security. Whether you're off to the Middle East, Australia, or Europe, this Health and Insurance Checklist for Sri Lankans Going Abroad for Work ensures you're protected from unexpected medical costs and emergencies.

Why Health and Insurance Matter for Sri Lankan Migrant Workers

Every year, thousands of us head abroad for better-paying jobs in construction, nursing, or domestic work. But without proper coverage, a simple accident or illness can wipe out your savings. International health insurance goes beyond basic travel policies, offering comprehensive protection tailored to long-term stays.[1][2] Unlike short-term travel insurance, which skips routine care and chronic conditions, international plans cover hospitalisations, doctor visits, and even maternity if you're planning a family.[1][2]

In 2026, with rising medical costs globally, expat-style insurance is essential. It provides access to private hospitals abroad, direct billing to avoid upfront payments, and evacuation if local facilities fall short.[3][4] For Sri Lankans, this means peace of mind while sending money home to your family in Colombo or Kandy.

Essential Health Checklist Before You Leave Sri Lanka

Start preparations at least 3-6 months ahead. Visit your local GP or a clinic like the Nawaloka Hospital in Colombo for a full check-up. Here's your step-by-step health prep:

- Full Medical Examination: Get blood tests, chest X-rays, and screenings for tuberculosis (TB), HIV, and hepatitis—common requirements for work visas in Gulf countries.[2]

- Vaccinations: Update routine shots like MMR, tetanus, and hepatitis B. Check for destination-specific ones, such as yellow fever for Africa or meningococcal for Saudi Arabia. The Epidemiology Unit of Sri Lanka's Ministry of Health provides free or low-cost vaccines at public hospitals.[1]

- Dental and Vision Check: Fix any issues now—abroad, these can cost a fortune without coverage. Opt for a cleaning and eye test in Sri Lanka.

- Pre-Existing Conditions: Declare conditions like diabetes or hypertension early. Policies may exclude them, impose a 24-month moratorium, or charge higher premiums (loading).[1]

- Mental Health Screening: Many employers require proof you're fit for high-stress jobs. Don't ignore anxiety or depression—get a certificate from a psychiatrist.

- Medication Stock: Carry a 3-month supply of prescriptions with a doctor's letter, as refills abroad can be tricky.

Sri Lanka-Specific Health Resources

Head to the Sri Lanka Bureau of Foreign Employment (SLBFE) website or their offices in Battaramulla for free pre-departure medical clinics. They partner with approved labs for visa-compliant tests at LKR 15,000-25,000 in 2026 rates. Register with the Sri Lanka Foreign Employment Agency to access these services.

Comprehensive Insurance Checklist for Overseas Work

Don't rely solely on your employer's group plan—they often have low limits, no portability if you change jobs, and exclusions for dental or maternity.[2] Get personal international health insurance for full control. Here's what to tick off:

- Choose the Right Type: Opt for international health insurance over travel insurance for work stays over 3 months. Plans like AXA's Foundation to Prestige Plus offer inpatient/outpatient care, emergencies, and add-ons for dental/vision.[1]

- Coverage Essentials:

- Family Coverage: For spouses/kids, expect €3,000-7,000 yearly for a family of four. Include pediatric vaccines and orthodontics.[3]

- Key Providers for Sri Lankans: Compare AXA, MSH International (up to USD 10 million multi-trip), or local brokers via Pacific Prime. Get quotes online—tailor by age, destination, and health.[1]

- Visa and Employer Requirements: Gulf jobs often mandate USD 30,000+ medical coverage. Carry proof of insurance with your passport name and emergency contacts.[8]

- Portability Check: Ensure it follows you if you switch jobs—no gaps in coverage.[2]

Cost-Saving Tips for 2026

Premiums start at LKR 150,000/year for basic plans. Buy early for no waiting periods, bundle with life insurance via SLBFE-approved agents, and choose higher deductibles to lower costs. Compare 50,000+ plans via brokers for the best fit.[1]

Legal and Practical Steps in Sri Lanka

Under the Sri Lanka Bureau of Foreign Employment Act, all outbound workers must register and get pre-departure orientation. While travel insurance isn't mandatory for entry to most countries, work visas demand health proofs.[7][8] Visit SLBFE for subsidised insurance options or tie-ups with Allianz or Ceylinco—up to LKR 5 million coverage at affordable rates.

Pack smart: Digital copies of policies, SLBFE ID card, and emergency contacts for Sri Lanka Embassy abroad. Inform your family back home about claims processes.

Common Pitfalls to Avoid

- Ignoring exclusions—read fine print for chronic illnesses.

- Underinsuring for evacuations, vital if working in remote sites.[4]

- Forgetting renewals—set calendar reminders.

- Assuming employer covers everything—get supplemental personal insurance.[2]

Next Steps to Get Started

1. Book your SLBFE medical today.

2. Compare quotes from AXA/MSH via brokers.

3. Register with SLBFE and pack proofs.

4. Share details with family and employer.

With this checklist, you'll step abroad confidently, focusing on building your future without health worries. Safe travels and best of luck!

Frequently Asked Questions

Sources & References

-

1

International Health Insurance for Expats in Sri Lanka — pacificprime.com — www.pacificprime.com

- 2

- 3

-

4

A Guide to the Sri Lanka Healthcare System for Expats — expatfinancial.com — expatfinancial.com

-

5

Health Coverage for Expats in Sri Lanka: What to Know — lifeloveanddirtydishes.com — lifeloveanddirtydishes.com

-

6

Sri Lanka Travel Health Insurance - Country Review — aardy.com — www.aardy.com

-

7

Sri Lanka Travel Insurance — insubuy.com — www.insubuy.com

- 8

All sources were accessed and verified as of March 2026. External links open in new tabs.

Related Articles

Gap-Year Options Abroad for Young Sri Lankans: Work, Travel, and Study

Taking a gap year abroad is an exciting opportunity for young Sri Lankans to develop new skills, gain international experience, and explore the world before committing to further studies or a career....

Skilled Independent Visa (Subclass 189) for Sri Lankans: Requirements and Process

Imagine landing a permanent job in Australia, with the freedom to live and work anywhere from Sydney's bustling streets to Perth's sunny shores—no sponsor required. For skilled Sri Lankans like engine...

LinkedIn and CV Optimization for Sri Lankans Looking for Jobs Abroad

Landing a job abroad is a dream for many Sri Lankans, but your LinkedIn profile and CV are often the first impression you'll make with international employers. With competition fiercer than ever, opti...

How to Sponsor Parents from Sri Lanka: Canada, UK, and Australia Compared

Imagine bringing your parents from Colombo or Kandy to live with you in Canada, the UK, or Australia – sharing family meals, festivals like Vesak, and everyday joys without the distance. For many Sri...