Sri Lanka Foreign Reserves Update January 2026: Risks and Government Policy Responses

As we navigate 2026, Sri Lanka's foreign reserves have captured our attention with a slight dip in January, dipping to USD 6,824 million from USD 6,838 million the previous month.[1] This marginal dec...

As we navigate 2026, Sri Lanka's foreign reserves have captured our attention with a slight dip in January, dipping to USD 6,824 million from USD 6,838 million the previous month.[1] This marginal decline amid ongoing debt repayments raises questions about our economic stability, but the Central Bank's steady policies offer reassurance for locals watching their savings and imports closely.

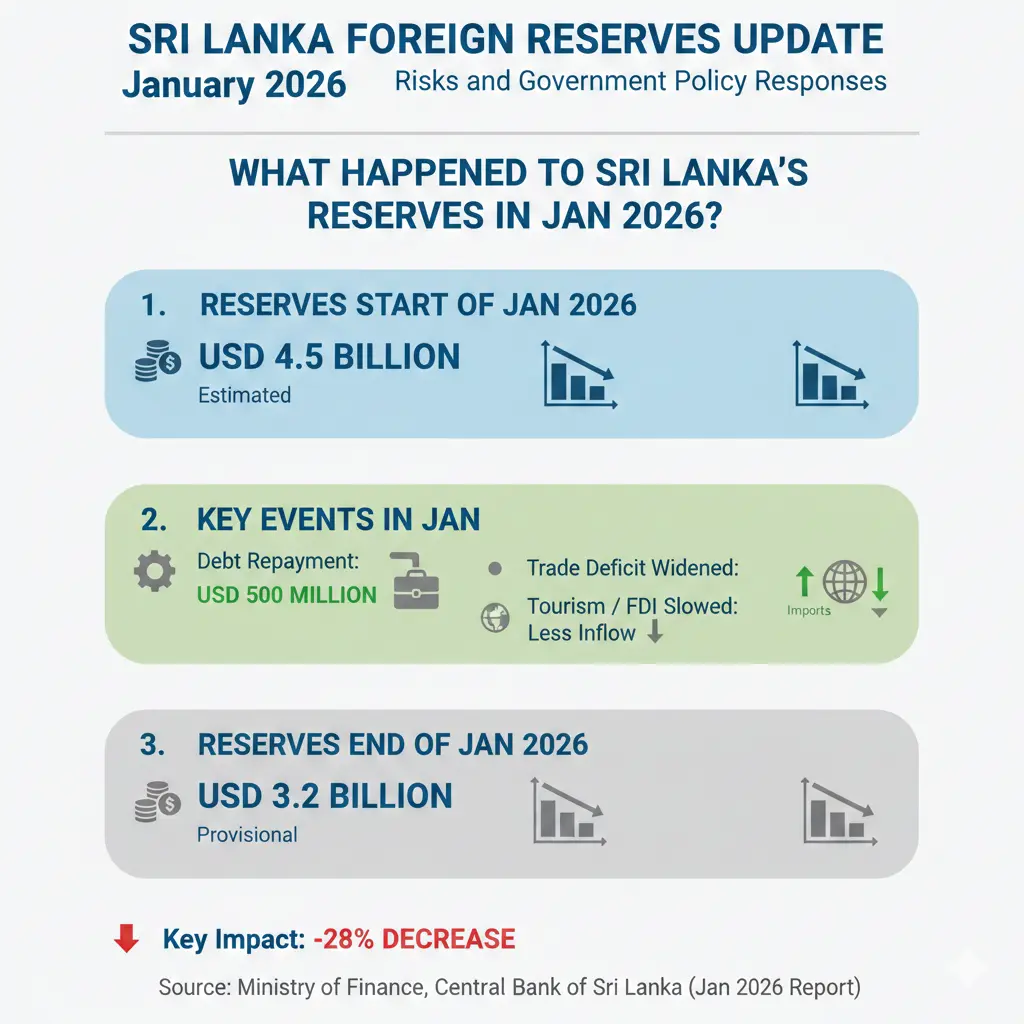

What Happened to Sri Lanka's Reserves in January 2026?

Our official reserve assets, a key buffer against economic shocks, saw a 0.2% drop in January 2026.[1][2] Foreign exchange reserves—the biggest chunk—fell 1% from USD 6,747 million to USD 6,680 million.[1][3] On a brighter note, gold holdings surged 26.8% to USD 109 million, providing some offset.[1][2]

These figures come straight from the Central Bank of Sri Lanka (CBSL), showing reserves held steady around USD 6.8 billion by late 2025 despite heavy debt servicing.[5] Importantly, about USD 1.4 billion of this includes a swap from China's People's Bank, usable under specific conditions.[1][2] For us in Sri Lanka, this means our ability to import essentials like fuel and medicine remains protected, covering roughly 3.1 months of imports as of late 2025.[3]

Breaking Down the Numbers

- Official Reserves: USD 6,824 million (end-January 2026) vs. USD 6,838 million (end-December 2025).[1]

- Foreign Exchange: USD 6,680 million, down from USD 6,747 million.[1][3]

- Gold Holdings: Up to USD 109 million from USD 86 million.[1]

- Historical Context: Peak at USD 9.0 billion in 2018; current levels are rebuilding post-crisis.[3]

This dip isn't alarming yet—it's marginal—but it highlights pressures from global factors and our debt obligations.

Key Risks Facing Sri Lanka Reserves in 2026

With Sri Lanka reserves 2026 under scrutiny, several risks loom large. Debt repayments continue to drain our coffers, even as inflows from remittances and multilateral aid help.[5] The trade deficit widened in 2025, though a current account surplus cushioned the blow.[5]

Debt Repayments and External Pressures

We've faced massive outflows for international bonds and loans, yet built reserves to USD 6.8 billion by end-2025 through CBSL forex purchases and agency support.[5] In 2026, expect similar strains: maturing debts, potential oil price spikes, and a depreciating rupee (down 5.6% in 2025).[5]

Domestic Vulnerabilities

- Import Dependence: Fuel, food, and post-cyclone rebuilding imports could pressure reserves if tourism or exports lag.

- Weather and Geopolitics: Adverse events like cyclones or global tensions might hike food/energy costs, eroding reserves.[5]

- Credit Growth: Expanding private credit (up amid vehicle imports and recovery) fuels demand but risks inflation.[5]

For locals, this translates to watching fuel queues or grocery prices—reserves below 3 months' imports signal vulnerability under CBSL guidelines.

Global Comparisons

Our USD 6.7 billion foreign exchange pales against neighbours: Philippines at USD 87 billion, India far higher.[3] But relative to size, we're stabilising—better than 2022 lows.

Government Policy Responses: Steady Hand at the Helm

The CBSL's response? Keeping the Overnight Policy Rate (OPR) at 7.75% in January 2026, balancing growth and inflation.[5] This anchors the rupee and supports reserve rebuilding.

Monetary Tools in Action

Key measures include:

- Forex Interventions: CBSL buys dollars to build reserves, backed by remittances (healthy in 2025).[5]

- Debt Restructuring: Ongoing IMF-backed deals extend maturities, easing 2026 outflows. Check the Finance Ministry's portal for updates.

- Export and Tourism Push: Policies target apparel, tea, and visitor arrivals to boost inflows—tourism hit records pre-2026.

- Swap Lines: The USD 1.4 billion China swap acts as a lifeline, though conditional.[1]

Under the 2022 IMF programme (still guiding us), fiscal discipline caps deficits, with public finance laws mandating reserve adequacy.[5]

What This Means for You

As a local, diversify savings into rupees or gold (mirroring CBSL's strategy). Businesses: Hedge imports via forward contracts from commercial banks. Stay informed via CBSL's weekly bulletins.

Practical Tips for Sri Lankans in 2026

Here's actionable advice to weather reserve fluctuations:

- Households: Build a 3-6 month emergency fund in a mix of LKR fixed deposits (yielding 8-10%) and USD accounts at banks like Commercial Bank or HNB.

- Businesses: Use CBSL's export credit refinance scheme for cheaper loans. Monitor the rupee via the CBSL app.

- Investors: Eye Treasury bills (stable returns) or unit trusts tracking reserves indirectly.

- Track Reserves: Visit CBSL website for real-time data; subscribe to alerts.

Post-cyclone recovery? Government relief funds prioritise essentials, but personal preparedness counts.

Outlook for Sri Lanka Reserves in 2026

Expect modest rebuilding if tourism surges and exports hold. Risks like geopolitical flares could test us, but CBSL's vigilance—OPR steady, inflation contained—positions us well.[5] By mid-2026, reserves could nudge USD 7 billion with favourable winds.

Next Steps for You

Check CBSL's latest data today, review your budget for import costs, and consider rupee-stable investments. Our economy's resilient—stay informed to make smart moves. For personalised advice, consult a licensed advisor via the CBSL registry.

Frequently Asked Questions

Sources & References

- 1

- 2

-

3

Sri Lanka Foreign Exchange Reserves, 1956–2026 | CEIC Data — www.ceicdata.com

-

4

Sri Lanka - International Reserves (excluding Gold) - Trading Economics — tradingeconomics.com

-

5

Monetary Policy Review No. 01 – January 2026 - Central Bank of Sri Lanka — www.cbsl.gov.lk

-

6

Sri Lanka's Reserves Observe Marginal Dip in January 2026 - The Morning Money — themorningmoney.com

All sources were accessed and verified as of March 2026. External links open in new tabs.

Useful Tools

Related Articles

2026 Sri Lanka Economic Recovery Indicators: Government Targets Explained

Sri Lanka's economy is showing signs of resilience after the devastating 2022 crisis, and 2026 is shaping up to be a crucial year for our nation's recovery. The government and Central Bank have set am...

Sri Lanka Worker Remittances Policy Enhancements: Record $8B in 2025-2026

Sri Lanka's worker remittances have reached unprecedented levels, hitting a record USD 8.076 billion in 2025[1], marking a remarkable 22.8% increase from the previous year. This surge reflects not jus...

World Bank Insights: Optimizing Public Spending Under Sri Lanka's 2026 Fiscal Constraints

As Sri Lankans, we're all feeling the pinch of tighter public budgets in 2026, with the government's fiscal deficit hitting 3.7 trillion rupees while debt servicing eats up 4.5 trillion rupees.Sri Lan...

Foreign Investment Policies in Sri Lanka 2026: Non-Resident Rules, ECB Limits, and How to Navigate

Sri Lanka's economy is on the rise, with foreign direct investment (FDI) already surpassing US$1 billion in 2025 and projections hitting 1.5 to 2 billion USD in 2026.FDI Sri Lanka 2026 looks brighter...