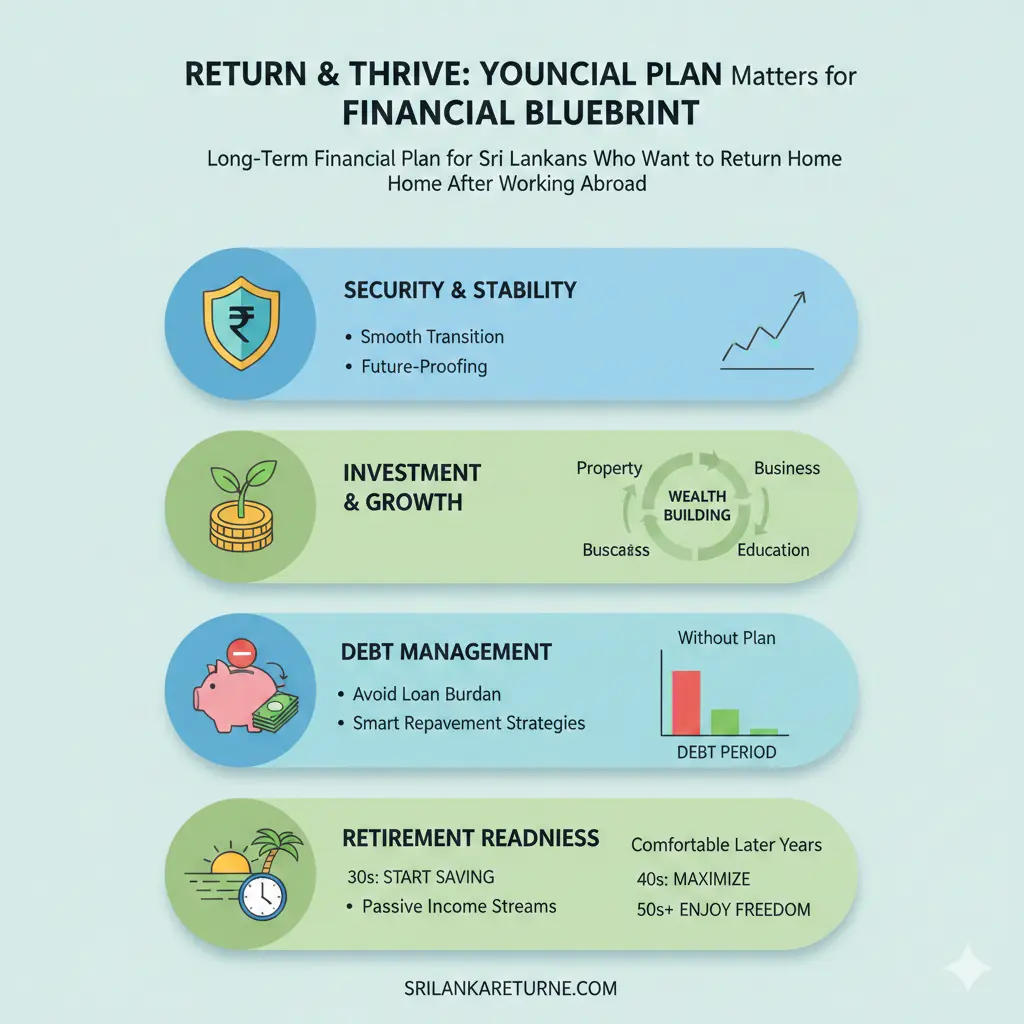

Long-Term Financial Plan for Sri Lankans Who Want to Return Home After Working Abroad

Imagine wrapping up years of hard work abroad, boarding a flight back to Sri Lanka, and stepping into a future where your savings work as hard as you did. For many Sri Lankans who've built careers in...

Imagine wrapping up years of hard work abroad, boarding a flight back to Sri Lanka, and stepping into a future where your savings work as hard as you did. For many Sri Lankans who've built careers in the Middle East, Europe, or beyond, returning home isn't just a dream—it's a smart move with the right long-term financial plan. With our cost of living staying affordable and new opportunities blooming, now's the time to turn those foreign earnings into lasting security right here on our island.

Why a Long-Term Financial Plan Matters for Returnees

Returning home after years abroad means shifting from expat life to local realities. You've likely saved in foreign currencies, but Sri Lanka's economy—with its recovering tourism, digital nomad influx, and diaspora investments—offers real potential.[4] A solid plan helps you navigate taxes, inflation, and lifestyle changes without dipping into your nest egg prematurely.

Start by assessing your situation: list pensions, investments, property, and debts across countries. This "one-page financial map" cuts through fragmentation, a common pitfall for expats.[2] In Sri Lanka, where the cost of living is about 49% lower than the UK, a single person's monthly expenses (excluding rent) hover around US$467—or roughly LKR 140,000 at current rates.[1] Factor in urban rents from LKR 60,000–300,000 (US$200–1,000) for a basic house, and you'll see why precise budgeting is key.[3]

Step 1: Build Your Emergency Cash Buffer

Life throws curveballs—visa renewals, health scares, or currency dips. Aim for 6–12 months of living expenses in liquid savings. For a family of four in Colombo, that's LKR 1.5–3 million (US$5,000–10,000). Keep it in a mix of USD accounts abroad and local savings here. Most Sri Lankan banks require a minimum deposit of LKR 157,725 (US$500) for savings or LKR 316,075 (US$1,000) for fixed deposits—easy to meet with your overseas funds.[1]

- Open a local bank account early: Visit a branch with your passport, visa, proof of address, and income docs. Commercial Bank or HNB offer expat-friendly options with online access.

- Diversify currencies: Hold 50% in LKR for daily use, 50% in USD to hedge rupee volatility.

- Pro tip: Use the Inland Revenue Department's online portal to track any remittance taxes before transferring funds.

Step 2: Tackle Taxes and Residency Smartly

Sri Lanka taxes non-residents only on local income, but returnees quickly become residents, liable for worldwide income.[1] The 2023/2024 personal income tax revisions raised the tax-free threshold to LKR 150,000 monthly (about US$510), with rates starting at 1.5% up to LKR 250,000—much kinder for modest earners.[1] Over LKR 308,333? It's 36%, so plan withdrawals wisely.

If you're 55+, consider the "My Dream Home" retirement visa: deposit US$15,000 fixed in a local bank, plus US$1,500 monthly (US$750 for a spouse). It simplifies long-term stays without constant renewals.[4] Consult the Department of Immigration and Emigration for 2026 updates—their site lists approved banks like People's Bank.

Investing Your Savings for Sri Lankan Life

Don't let inflation erode your hard-earned cash. Sri Lanka's unit trust funds and government securities yield 10–15% in 2026, beating bank deposits.[2] Separate your money into "pots": core for living costs, flexibility for travel/health, and legacy for family.[2]

Property: A Cornerstone Investment

Buying a home stabilises costs and builds wealth. Basic houses cost LKR 15–60 million (US$50,000–200,000), cheaper in rural areas.[3] As a citizen, you face no foreign buyer restrictions—check the Urban Development Authority for land titles. New diaspora-driven developments in Galle and Kandy offer modern flats from LKR 25 million, with rising values thanks to tourism.[4]

| Location | Rent (Monthly, LKR) | Buy (Basic House, LKR) |

|---|---|---|

| Rural | 60,000–150,000 | 15–30 million |

| Colombo Urban | 150,000–300,000 | 30–60 million |

| Galle/Kandy | 100,000–250,000 | 25–50 million |

Other Investments: Stocks, Units, and Pensions

Colombo Stock Exchange (CSE) indices have rebounded, with blue-chips like John Keells yielding dividends. Start with Central Bank-approved unit trusts via NDB or Hatton National Bank—minimums as low as LKR 50,000. For pensions, consolidate foreign ones tax-efficiently; the EPF accepts transfers for locals.[2]

- Monthly money meetings: 15 minutes to review savings rate and expenses.[2]

- Investment ruleset: Define your risk tolerance—e.g., 60% equities, 40% fixed income—and stick to it.

Healthcare and Insurance: Protect Your Future

Our public system is solid but crowded; private care in Colombo's Nawaloka or Asiri hospitals costs LKR 50,000+ for basics. Expats and returnees need international health insurance for direct billing and evacuations—essential with private fees adding up fast.[5] Plans from Allianz or Cigna cover Sri Lanka networks, starting at LKR 100,000/year per person.[5]

Checklist before return:

- Secure coverage for maternity, dental, and emergencies.

- Budget LKR 20,000–50,000 monthly for family premiums.

- Enrol in NHDA (National Health Development Authority) for public supplements.

Daily Budgeting and Lifestyle Adjustments

A comfortable Colombo life for a family: LKR 400,000–600,000 monthly (groceries LKR 80,000, utilities LKR 30,000, transport LKR 50,000).[1][3] Cut costs with local markets and public buses. Gyms or spas? Just 20% of Western prices.[4]

Track via apps like Money Manager, aligned with annual cross-border reviews.[2]

Next Steps to Secure Your Future

Grab a notebook: map your finances today, open that bank account next week, and book a financial advisor chat via the CFA Sri Lanka directory. We're seeing more returnees thrive—join them with disciplined habits like monthly reviews and diversified pots.[2] Your abroad grind was step one; this plan makes home your best chapter yet. Start small, stay consistent, and watch your wealth grow on familiar soil.

Frequently Asked Questions

Sources & References

-

1

A Guide To Moving To Sri Lanka As An Expat | William Russell — www.william-russell.com

- 2

-

3

Living in Sri Lanka - Expat Exchange — www.expatexchange.com

-

4

Why We Have Decided to Spend Half the Year Living in Sri Lanka | International Living — internationalliving.com

- 5

All sources were accessed and verified as of March 2026. External links open in new tabs.

Related Articles

Construction Jobs in Israel and Romania for Sri Lankans: Contracts, Salaries, and Risks

Imagine earning a salary that could transform your family's life back home in Sri Lanka—enough to build a house in Colombo, pay off debts, or fund your children's education. That's the promise drawing...

Total Cost to Migrate to Canada from Sri Lanka: Fees, Proof of Funds, and Hidden Charges

Planning your move to Canada from Sri Lanka? The total cost can easily exceed LKR 5-10 million depending on your family size and pathway, covering application fees, proof of funds, and those sneaky ex...

Best Ways to Send Money to Sri Lanka from Abroad: Avoiding Undiyal and High Fees

Sending money to Sri Lanka from abroad doesn't have to drain your wallet. Whether you're supporting family back home or managing business expenses, understanding your options can save you hundreds of...

Pathways for Sri Lankan Engineers to Work in Canada, Australia, and the Middle East

This article references the following sources for accuracy and further reading: