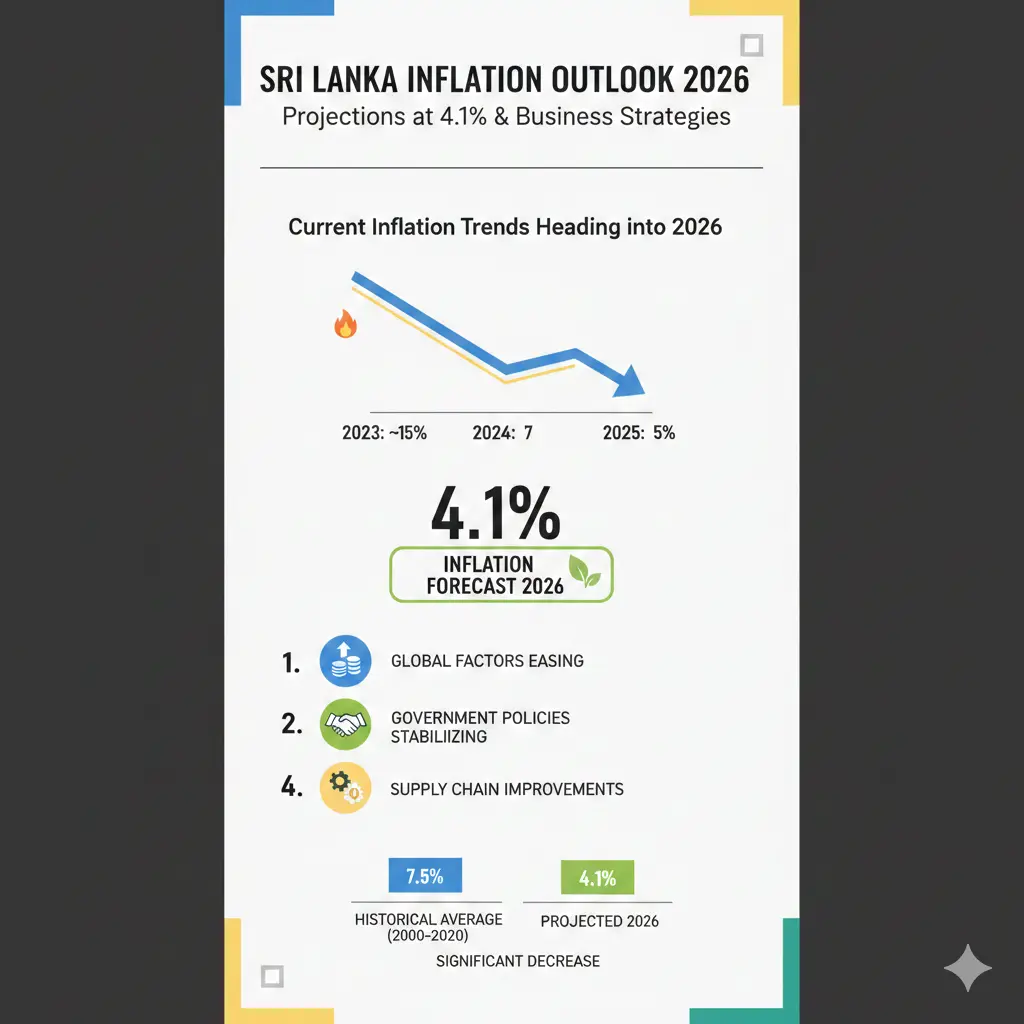

Sri Lanka Inflation Outlook 2026: Projections at 4.1% and Business Strategies

As we navigate 2026, Sri Lanka's inflation outlook points to a modest rise to around 4.1%, staying below the Central Bank's 5% target and paving the way for supportive monetary policies that benefit b...

As we navigate 2026, Sri Lanka's inflation outlook points to a modest rise to around 4.1%, staying below the Central Bank's 5% target and paving the way for supportive monetary policies that benefit businesses and households alike.[1][2] This stability, amid recovering reserves and subdued global commodity prices, means we're in a stronger position to plan ahead—whether you're running a small shop in Colombo or managing a factory in the hill country.

Current Inflation Trends Heading into 2026

Sri Lanka's inflation has remained low through late 2025 and early 2026, providing a solid foundation for growth. In January 2026, annual inflation in Colombo reached 2.3%, up slightly from 2.1% in December 2025—the highest since July 2024 but still well-contained.[3] Food inflation ticked up to 3.3%, influenced by Cyclone Ditwah's short-term disruptions to crops and supply chains, yet prices have stabilised quickly.[2][3]

The Central Bank of Sri Lanka (CBSL) reports that inflation stayed subdued in 2025, enabling an accommodative monetary policy.[1] Gross official reserves hit over US$6.8 billion by end-2025, bolstered by CBSL's US$2 billion in net foreign exchange purchases and multilateral inflows.[1] This buffer supports exchange rate flexibility while building reserves to meet adequacy standards.

Key Drivers Keeping Inflation in Check

- Lower global commodity prices: A major factor projecting inflation at ~4.1% for 2026, even with a potential 10% electricity tariff hike factored in.[2]

- Stable currency and reserves: Manageable depreciation and strengthened macroeconomic buffers reduce imported inflation risks.[1][2]

- Post-cyclone recovery: Supply disruptions from Cyclone Ditwah proved short-lived, with food essentials stabilising swiftly.[2]

Trading Economics forecasts inflation at 2.5% by end-Q1 2026, trending to 3.4% in 2027 and 4% in 2028, aligning with CBSL's flexible inflation targeting framework.[3]

Sri Lanka Inflation Forecast for 2026: 4.1% Projection

Experts project Sri Lanka inflation 2026 at approximately 4.1%, rising gradually from 2025's average of -0.5% but remaining below the CBSL's 5% target by year-end.[1][2] CBSL Governor Nandalal Weerasinghe notes this uptick will return to target in the second half, supported by 4-5% economic growth, improved reserves, and low inflation.[1]

CAL Sri Lanka's analysis reinforces this inflation forecast, citing lower global commodities and stable rupee as anchors, even post-cyclone.[2] Upside risks include supply shocks or reconstruction demand after Cyclone Ditwah, while downside pressures could emerge if electricity tariffs stay flat.[1][2]

Policy Response: Rate Cuts on the Horizon

Low inflation enables CBSL to maintain its accommodative stance, with policy rates already lowered in line with regional trends.[1][4] This supports rate cuts, easing borrowing costs for businesses and consumers. Under the Monetary Law Act, CBSL targets price stability while fostering growth, publishing its policy agenda annually for transparency.[1]

For us in Sri Lanka, this means cheaper loans from banks like Commercial Bank or HNB, helping expand operations without crippling interest payments.

Business Strategies to Thrive Amid 4.1% Inflation

With Sri Lanka inflation 2026 forecast at 4.1%, businesses can plan confidently. Low inflation supports pricing stability, cost control, and investment—key for our post-crisis recovery.

Pricing and Cost Management Tips

- Lock in supplier contracts: Negotiate fixed-price deals for imports like fuel or fertiliser, hedging against any gradual rise.[2]

- Adjust pricing gradually: For retailers in Pettah or Kandy markets, pass on 2-3% hikes mid-year, aligning with the projected trajectory to target.[1]

- Monitor CEB tariffs: Budget for a possible 10% increase; if avoided, reinvest savings into stock.[2]

Investment and Expansion Opportunities

Leverage rate cuts for capital investments. Construction firms can tap low-cost loans for Cyclone Ditwah rebuilding, while exporters benefit from stable reserves.[1] Visit the Board of Investment (BOI) portal at investsrilanka.com for incentives in tourism or apparel.

- Diversify sourcing: Shift to local rice or vegetables post-cyclone lessons, reducing import reliance.

- Build cash buffers: Aim for 6-12 months' reserves, using CBSL's exchange flexibility.

- Digital tools: Use apps like PickMe or Uber for logistics cost-tracking in real-time.

Risk Mitigation for Local Enterprises

Small businesses in Galle or Jaffna should watch food inflation (currently 3.3%) via the Department of Census and Statistics dashboard at statistics.gov.lk.[3] Join the Chamber of Young Entrepreneurs (CYEN) for peer advice on navigating upside risks like geopolitical tensions.[1]

Table: Inflation Impact on Key Sectors

| Sector | 2026 Projection Impact | Strategy |

|---|---|---|

| Retail & Food | 3.3% food rise, stabilising | Local sourcing, dynamic pricing |

| Manufacturing | Low energy costs if tariffs flat | Export focus with reserves |

| Tourism | Stable rupee aids visitors | Invest in eco-resorts |

| Construction | Reconstruction demand | Secure BOI loans |

Household and Personal Finance Tips

For families, 4.1% inflation means budgeting for essentials rises modestly. Track via the CBSL website at cbsl.gov.lk.[1]

- Shop at Economic Centre for bulk deals.

- Fixed deposits at 8-10% beat inflation—check Peoples Bank rates.

- Avoid debt for non-essentials as rates may ease further.

Next Steps for Businesses and Households

Stay ahead by subscribing to CBSL's monthly reports and joining local chambers. Review your budgets quarterly, locking in rates before cuts materialise. With 4.1% inflation and 4-5% growth, 2026 offers stability—use it to build resilience against risks like global volatility.[1] Download the CBSL app or visit cbsl.gov.lk today for the latest.

Frequently Asked Questions

Sources & References

-

1

Sri Lanka expects 4-5 pct growth in 2026: central bank - Xinhua — english.news.cn

-

2

Inflation Outlook & Price Stability | CAL Sri Lanka - YouTube — www.youtube.com

-

3

Sri Lanka Inflation Rate - Trading Economics — tradingeconomics.com

-

4

Global Economic Prospects -- January 2026 - The World Bank — thedocs.worldbank.org

All sources were accessed and verified as of March 2026. External links open in new tabs.

Useful Tools

Related Articles

2026 Sri Lanka Economic Recovery Indicators: Government Targets Explained

Sri Lanka's economy is showing signs of resilience after the devastating 2022 crisis, and 2026 is shaping up to be a crucial year for our nation's recovery. The government and Central Bank have set am...

Sri Lanka Worker Remittances Policy Enhancements: Record $8B in 2025-2026

Sri Lanka's worker remittances have reached unprecedented levels, hitting a record USD 8.076 billion in 2025[1], marking a remarkable 22.8% increase from the previous year. This surge reflects not jus...

World Bank Insights: Optimizing Public Spending Under Sri Lanka's 2026 Fiscal Constraints

As Sri Lankans, we're all feeling the pinch of tighter public budgets in 2026, with the government's fiscal deficit hitting 3.7 trillion rupees while debt servicing eats up 4.5 trillion rupees.Sri Lan...

Foreign Investment Policies in Sri Lanka 2026: Non-Resident Rules, ECB Limits, and How to Navigate

Sri Lanka's economy is on the rise, with foreign direct investment (FDI) already surpassing US$1 billion in 2025 and projections hitting 1.5 to 2 billion USD in 2026.FDI Sri Lanka 2026 looks brighter...