Sri Lanka Central Bank Policy Agenda 2026: Key Reforms for Economic Stability and Growth

The Central Bank of Sri Lanka (CBSL) has unveiled its comprehensive policy agenda for 2026, signalling a measured approach to monetary stability whilst supporting economic recovery. As we navigate a c...

The Central Bank of Sri Lanka (CBSL) has unveiled its comprehensive policy agenda for 2026, signalling a measured approach to monetary stability whilst supporting economic recovery. As we navigate a critical year for Sri Lanka's financial system, understanding these key reforms—from interest rate decisions to banking sector changes—will help you make informed decisions about your finances and investments.

Understanding the CBSL's 2026 Monetary Policy Stance

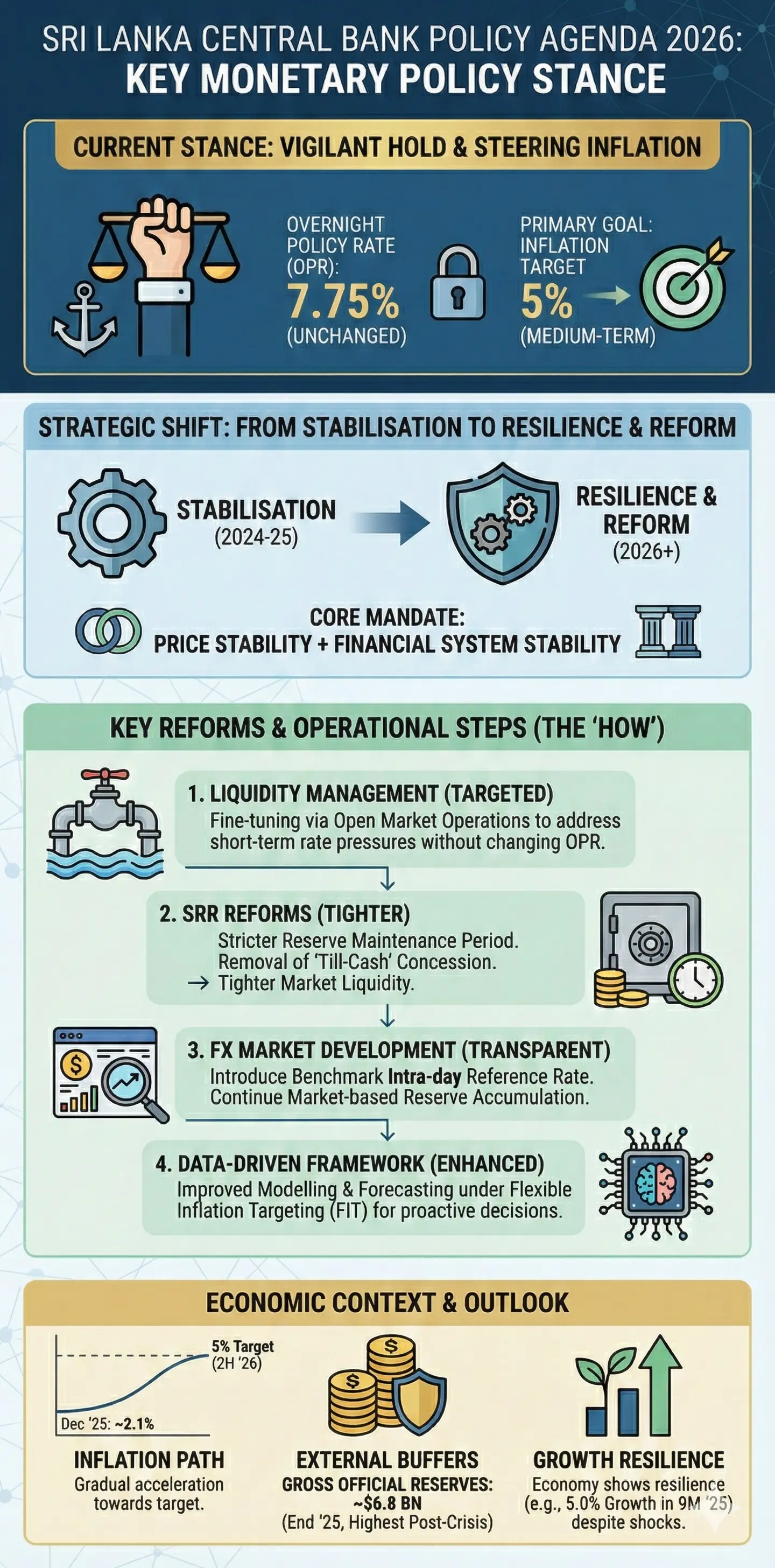

The CBSL is maintaining a cautious yet steady monetary policy in 2026, with interest rates expected to remain stable in the early part of the year.[1] In January 2026, the Monetary Policy Board decided to keep the Overnight Policy Rate (OPR) at 7.75%, reflecting confidence in the macroeconomic stability restored during 2024 and 2025.[2]

This decision reflects the Central Bank's commitment to steering inflation back to its medium-term target of 5%. According to the CBSL's projections, inflation will return to this target by the second half of 2026, even accounting for economic impacts from Cyclone Ditwah on supply chains.[1]

What does this mean for you? A stable policy rate environment suggests that borrowing costs for mortgages, personal loans, and business credit are unlikely to spike dramatically in the near term. However, the CBSL has made clear that moderate rate changes aren't entirely ruled out if economic conditions warrant them.

Key Monetary Policy Reforms Coming in 2026

The New Overnight Policy Rate (OPR) Mechanism

The CBSL streamlined its monetary policy implementation in 2025 by introducing a single policy rate mechanism through the OPR.[3] This replaces the previous dual-rate system and provides clearer signalling to financial markets about the Central Bank's policy intentions. The OPR is now the key benchmark that influences borrowing and lending rates across the economy.

Statutory Reserve Ratio (SRR) Framework Changes

One of the most significant reforms affecting banks—and indirectly, your financial services—involves changes to the Statutory Reserve Ratio (SRR) framework.[3] The CBSL will implement several modifications in 2026:

- Redefining the Reserve Maintenance Period (RMP) to align with international best practices

- Phased removal of the till-cash concession previously given to banks

- Increased daily minimum reserve requirements for financial institutions

These changes effectively reverse temporary relaxations introduced during the COVID-19 pandemic. Why does this matter? Tighter reserve requirements will put upward pressure on short-term interest rates, which could modestly increase rates on short-term deposits and loans. However, long-term yields are expected to remain relatively stable, supported by anchored inflation expectations and ongoing fiscal consolidation.[1]

Liquidity Management Rather Than Rate Hikes

The CBSL has signalled its preference for managing liquidity through targeted operations rather than immediate policy rate changes.[1] This approach aims to preserve monetary stability whilst continuing to support economic growth. The Central Bank will use tools like fine-tuning market liquidity and SRR adjustments to maintain the desired policy path.

Foreign Exchange and Trade Reforms

The CBSL is continuing its comprehensive review of the foreign exchange policy framework commenced in 2025.[3] Key priorities for 2026 include:

- Assessing policies related to non-resident investments in Sri Lankan companies

- Reviewing external commercial borrowing regulations for resident companies

- Introducing a benchmark intra-day reference exchange rate to foster a more transparent forex market

- Updating the base years for the Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) indices to better capture Sri Lanka's trade competitiveness

With all import restrictions now removed, these reforms support a more open and transparent foreign exchange market, benefiting businesses engaged in international trade.

Financial System Stability and Banking Sector Reforms

Banking Sector Recapitalisation and Consolidation

The CBSL's 2026 agenda prioritises financial system stability through several key initiatives.[1] The Master Plan Phase II will drive banking sector recapitalisation and consolidation, strengthening the resilience of our financial institutions.

New Capital Buffer Framework

A counter-cyclical capital buffer framework will be introduced to help banks build buffers during good economic times, which they can draw down during periods of stress.[1] This approach helps prevent financial instability and supports lending during economic downturns.

Climate Risk Integration

The CBSL will integrate climate-related risks into financial supervision, recognising that environmental challenges—like the recent Cyclone Ditwah—pose material risks to our financial system.[1] Banks will need to assess and manage climate-related exposures more rigorously.

Strengthened Deposit Insurance

The Sri Lanka Deposit Insurance Scheme (SLDIS) will be enhanced with World Bank support in 2026.[1] The CBSL will also launch public awareness initiatives to help depositors understand their protection under the scheme. These improvements strengthen the safety net for ordinary savers like you.

Comprehensive Banking Regulatory Review

The CBSL will conduct a comprehensive review of the regulatory framework applicable to the banking sector, including loan classification standards and risk management requirements.[3] This ensures that banks maintain high prudential standards and manage risks effectively.

Payment Systems and Financial Inclusion

The CBSL will prioritise improvements to the efficiency and effectiveness of Sri Lanka's payment systems whilst safeguarding their safety and resilience.[3] Legal reforms relating to payment and settlement systems are expected in 2026, supporting a more modern and inclusive financial infrastructure.

The Central Bank will also continue gradual relaxation of capital flow measures imposed since 2020, whilst conducting supervision and awareness programmes to strengthen compliance with regulatory frameworks.

Green and Sustainable Finance Expansion

Sri Lanka's commitment to sustainable finance will deepen in 2026 with the broadening of the Sri Lanka Green Finance Taxonomy to include social dimensions of sustainable finance.[2] This creates opportunities for investors and businesses interested in environmentally and socially responsible investments.

Anti-Money Laundering and Financial Crime Prevention

The Financial Intelligence Unit of Sri Lanka will continue strengthening the national AML/CFT/CPF (Anti-Money Laundering/Countering the Financing of Terrorism/Countering the Proliferation of Financing) framework.[2] A major milestone in 2026 will be Sri Lanka's third Mutual Evaluation on its AML/CFT/CPF framework, which assesses our compliance with international standards.

What This Means for Your Finances in 2026

Here's what these CBSL reforms mean in practical terms:

- Borrowers: Expect relatively stable interest rates on mortgages and loans in early 2026, though short-term rates may creep upward due to SRR tightening

- Savers: Your deposits are better protected through enhanced deposit insurance; however, returns on savings may remain modest as inflation gradually returns to 5%

- Investors: New opportunities in green and sustainable finance; long-term bond yields should remain relatively stable

- Businesses: More transparent forex markets and gradual relaxation of capital controls support international operations; climate risk assessments will become more important for financial access

- Exporters and Importers: Updated NEER and REER indices provide better clarity on exchange rate competitiveness

Looking Ahead: What You Should Do Now

As we move through 2026, here are practical steps to consider:

- Review your borrowing: Lock in current rates if you're planning major purchases, given potential upward pressure on short-term rates

- Check your deposit insurance: Verify that your bank deposits are covered under the SLDIS

- Assess climate risks: If you're a business owner, evaluate your climate-related exposures before approaching banks for financing

- Monitor inflation: Watch for inflation returning to 5% by mid-2026; this affects purchasing power and investment returns

- Explore green finance: Consider sustainable investment opportunities as the Green Finance Taxonomy expands

- Stay informed: Follow CBSL announcements on monetary policy decisions, which occur regularly throughout the year

The CBSL's 2026 policy agenda reflects a balanced approach: supporting economic recovery whilst ensuring price stability and strengthening financial resilience. By understanding these reforms, you're better positioned to make informed financial decisions for yourself and your business. Keep an eye on CBSL announcements throughout the year, as the Central Bank will continue to assess economic conditions and adjust its approach as needed.

Frequently Asked Questions

Sources & References

-

1

CBSL Signals Policy Stability as Inflation Path Narrows in 2026 — lankanewsweb.net

-

2

Central Bank's Policy Agenda for 2026 and Beyond (Presentation) — www.cbsl.gov.lk

-

3

Central Bank's Policy Agenda for 2026 and Beyond — www.cbsl.gov.lk

-

4

Monetary Policy Review No. 1 of 2026 — www.cbsl.gov.lk

All sources were accessed and verified as of March 2026. External links open in new tabs.

Related Articles

2026 Sri Lanka Economic Recovery Indicators: Government Targets Explained

Sri Lanka's economy is showing signs of resilience after the devastating 2022 crisis, and 2026 is shaping up to be a crucial year for our nation's recovery. The government and Central Bank have set am...

Sri Lanka Worker Remittances Policy Enhancements: Record $8B in 2025-2026

Sri Lanka's worker remittances have reached unprecedented levels, hitting a record USD 8.076 billion in 2025[1], marking a remarkable 22.8% increase from the previous year. This surge reflects not jus...

World Bank Insights: Optimizing Public Spending Under Sri Lanka's 2026 Fiscal Constraints

As Sri Lankans, we're all feeling the pinch of tighter public budgets in 2026, with the government's fiscal deficit hitting 3.7 trillion rupees while debt servicing eats up 4.5 trillion rupees.Sri Lan...

Foreign Investment Policies in Sri Lanka 2026: Non-Resident Rules, ECB Limits, and How to Navigate

Sri Lanka's economy is on the rise, with foreign direct investment (FDI) already surpassing US$1 billion in 2025 and projections hitting 1.5 to 2 billion USD in 2026.FDI Sri Lanka 2026 looks brighter...