Central Bank of Sri Lanka Policy Agenda 2026: What Businesses Need to Know

As business owners in Sri Lanka, we're all feeling the effects of the post-crisis recovery, from fluctuating interest rates to supply chain hiccups like those from Cyclone Ditwah. The Central Bank of...

As business owners in Sri Lanka, we're all feeling the effects of the post-crisis recovery, from fluctuating interest rates to supply chain hiccups like those from Cyclone Ditwah. The Central Bank of Sri Lanka's (CBSL) Policy Agenda for 2026 and Beyond lays out a clear roadmap to keep our economy steady at 4-5% growth while targeting 5% inflation—news that's crucial for planning your next investment or loan.[1][4] Here's what you need to know to stay ahead.

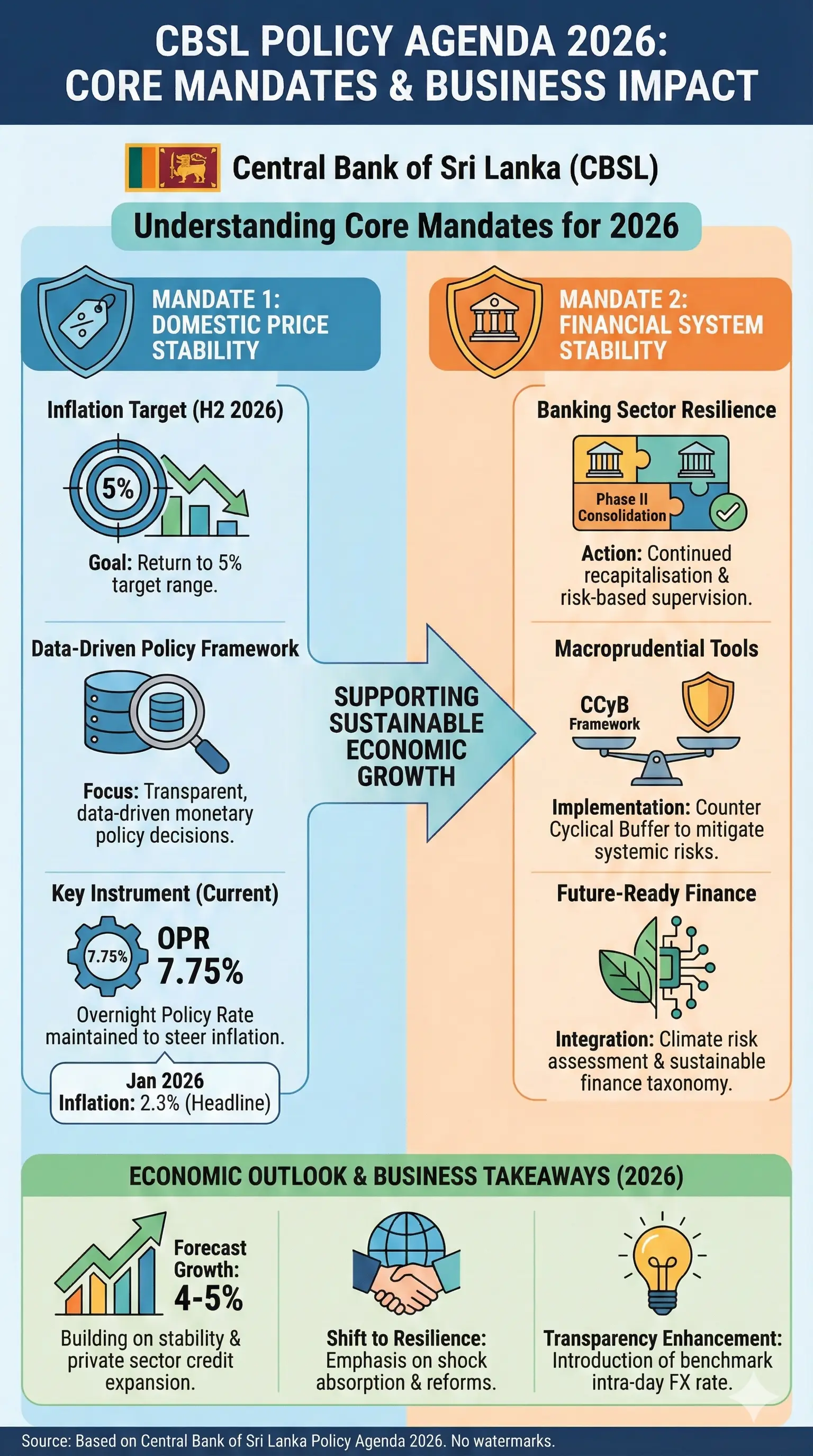

Understanding CBSL's Core Mandates for 2026

The CBSL's agenda focuses on three pillars: price stability, financial system stability, and economic growth support. Released on 8 January 2026, it builds on 2025's easing of monetary policy to foster recovery.[1] With the Overnight Policy Rate (OPR) held steady at 7.75% as of January 2026, the Bank signals confidence in steering inflation to its 5% target by mid-year.[2][4]

Price Stability: Inflation Targeting at 5%

Inflation, measured by the Colombo Consumer Price Index (CCPI), sat at 2.1% in December 2025, but food prices rose due to Cyclone Ditwah disruptions and festive demand.[4] CBSL projects a gradual rise to 5% by the second half of 2026, with core inflation (excluding food, energy, and transport) also accelerating as demand strengthens.[1][4][5]

- Actionable tip for businesses: Lock in supplier contracts now to hedge against food and energy price upticks. If you're in retail or hospitality, monitor CCPI monthly updates on the CBSL site.

- Expect short-term interest rates to align with the OPR through liquidity management—ideal for timing fixed-rate loans.[1]

The single policy rate mechanism, streamlined in 2025 via OPR, will continue, with enhancements to monetary operations infrastructure planned.[1] This means predictable borrowing costs for your SME expansions.

Economic Growth Projections: 4-5% for 2026

After 5% growth in the first nine months of 2025, CBSL forecasts 4-5% expansion in 2026, driven by reconstruction spending despite infrastructure risks.[1][4] Credit growth remains resilient post-Ditwah, supporting sectors like tourism and exports.[4]

| Sector | 2026 Outlook | Business Opportunity |

|---|---|---|

| Tourism & Services | Strong rebound | Invest in coastal resorts with stable rupee forecasts |

| Agriculture | Recultivation focus post-Ditwah | Supply chain tech for resilient farming |

| Exports | Improved competitiveness metrics | Apparel firms: Target new markets with trade data tools |

These projections assume steady fiscal paths and global stability—key for exporters facing geopolitical risks.[4]

Financial System Stability: Safeguarding Your Operations

CBSL prioritises a robust banking sector after the 2022 crisis lessons. Expect a comprehensive regulatory review in 2026, tightening loan classifications and risk management.[1]

Banking Supervision and Resolution Framework

Continuous surveillance will flag risks early, while the resolution framework—nearing completion—ensures orderly handling of distressed banks per international standards.[1] For businesses, this means safer deposits and lending.

"The 2022 crisis underscored the critical importance of having a well-established and effective resolution framework for the financial sector."[1]

Sri Lanka Deposit Insurance Scheme (SLDIS) Enhancements

SLDIS compensation payments continue building trust, with World Bank-backed upgrades to its fund base and awareness campaigns in 2026.[1] If your business holds corporate accounts, verify coverage limits via CBSL's portal—up to Rs. 1 million per depositor currently, with expansions likely.

Payment Systems and Financial Inclusion Upgrades

CBSL will boost payment efficiency with 2026 legal reforms and links to international platforms.[1] This is a game-changer for e-commerce businesses in Colombo or Kandy.

- Phase II of the National Financial Inclusion Strategy (NFIS) launches in 2026, expanding access for underserved areas like rural Sabaragamuwa.[1]

- Practical advice: Integrate LankaPay or new cross-border options to cut remittance fees for your garment export firm.

Exchange Rate and Reserve Management for Exporters

Reserves follow safety, liquidity, and return principles, with new trade competitiveness metrics.[1] Non-resident investments and external borrowings policies will be assessed—watch for eased rules boosting FDI in tech parks.

Upside inflation risks include rupee depreciation or weather events; downside from better agriculture output.[4] Exporters: Use CBSL's real-time exchange data for hedging.

AML/CFT and Broader Reforms

Sri Lanka's third Mutual Evaluation by the Asia Pacific Group (APG) in 2026 demands stronger anti-money laundering (AML), counter-terrorism financing (CFT), and counter-proliferation financing (CPF).[1] Businesses in trade finance must comply to avoid scrutiny.

- Update KYC processes for international deals.

- Train staff on CBSL AML guidelines, available free online.

Monetary Policy Tools and Reports

Under the Central Bank Act No. 16 of 2023, biannual Monetary Policy Reports offer insights— the February 2026 edition reaffirms the 5% target.[3][5][7] Next review: 25 March 2026.[4]

For businesses: Subscribe to CBSL alerts for OPR changes impacting your overdraft rates.

FAQ: Common Questions on CBSL Policy 2026

What does the 7.75% OPR mean for my business loan?

It keeps borrowing costs stable, supporting growth while curbing inflation. Expect no hikes soon if targets hold.[2]

Will inflation hit 5% on time?

Projections say yes by H2 2026, but Cyclone-like events pose risks. Core inflation will track closely.[4][5]

How does this affect SMEs in upcountry areas?

NFIS Phase II targets inclusion, with better payments access for places like Nuwara Eliya farmers.[1]

Should I worry about bank stability?

No—SLDIS enhancements and resolution frameworks make the system safer than post-2022.[1]

What's next for foreign investment rules?

CBSL reviews non-resident investments and ECBs in 2026 for sustainable inflows.[1]

Where to track updates?

CBSL website for reports; next policy review 25 March 2026.[4]

Next Steps for Your Business

Review your finances against the 5% inflation target—renegotiate loans if OPR stays low. Diversify suppliers post-Ditwah lessons, and explore NFIS for digital tools. Stay tuned to CBSL's site for the March review. By aligning with this agenda, we'll build a stronger economy together.

Sources & References

- Central Bank's Policy Agenda for 2026 and Beyond (PDF) — cbsl.gov.lk

- Monetary Policy Review No. 1 of 2026 — cbsl.gov.lk

- Central Bank of Sri Lanka Homepage — cbsl.gov.lk

- Monetary Policy Review No. 01 – January 2026 (PDF) — cbsl.gov.lk

- Monetary Policy Report – February 2026 (PDF) — cbsl.gov.lk

- Central Bank's Policy Agenda for 2026 and Beyond — cbsl.gov.lk

- The Central Bank of Sri Lanka releases the Monetary Policy Report — cbsl.gov.lk

- CBSL releases key report: Sees inflation reaching 5%, 2026 growth — ft.lk

Related Articles

Sri Lanka Central Bank Policy Agenda 2026: Key Reforms for Economic Stability and Growth

The Central Bank of Sri Lanka (CBSL) has unveiled its comprehensive policy agenda for 2026, signalling a measured approach to monetary stability whilst supporting economic recovery. As we navigate a c...

Sri Lanka IMF EFF Program 2026: Key Reforms and Impacts on Businesses

As we navigate 2026, Sri Lanka's IMF Extended Fund Facility (EFF) programme stands as a cornerstone of our economic revival, delivering vital funds and pushing through reforms that stabilise our finan...

How Sri Lanka's 2026 GDP Growth Forecast of 4-5% Affects Your Investments

Sri Lanka's economy is picking up speed, with the Central Bank forecasting a solid 4-5% GDP growth for 2026—good news for your savings, shares, and property investments.Sri Lanka GDP 2026 projections...

Sri Lanka Inflation Outlook 2026: Projections at 4.1% and Business Strategies

As we navigate 2026, Sri Lanka's inflation outlook points to a modest rise to around 4.1%, staying below the Central Bank's 5% target and paving the way for supportive monetary policies that benefit b...