Sri Lanka Debt Restructuring Progress 2026: Timeline and Economic Implications

As we navigate 2026, Sri Lanka's debt restructuring journey marks a turning point in our economic recovery. From the 2022 default to today's progress, we've restructured over 92% of external debt, sla...

As we navigate 2026, Sri Lanka's debt restructuring journey marks a turning point in our economic recovery. From the 2022 default to today's progress, we've restructured over 92% of external debt, slashing the debt-to-GDP ratio and paving the way for stability.[1][6]

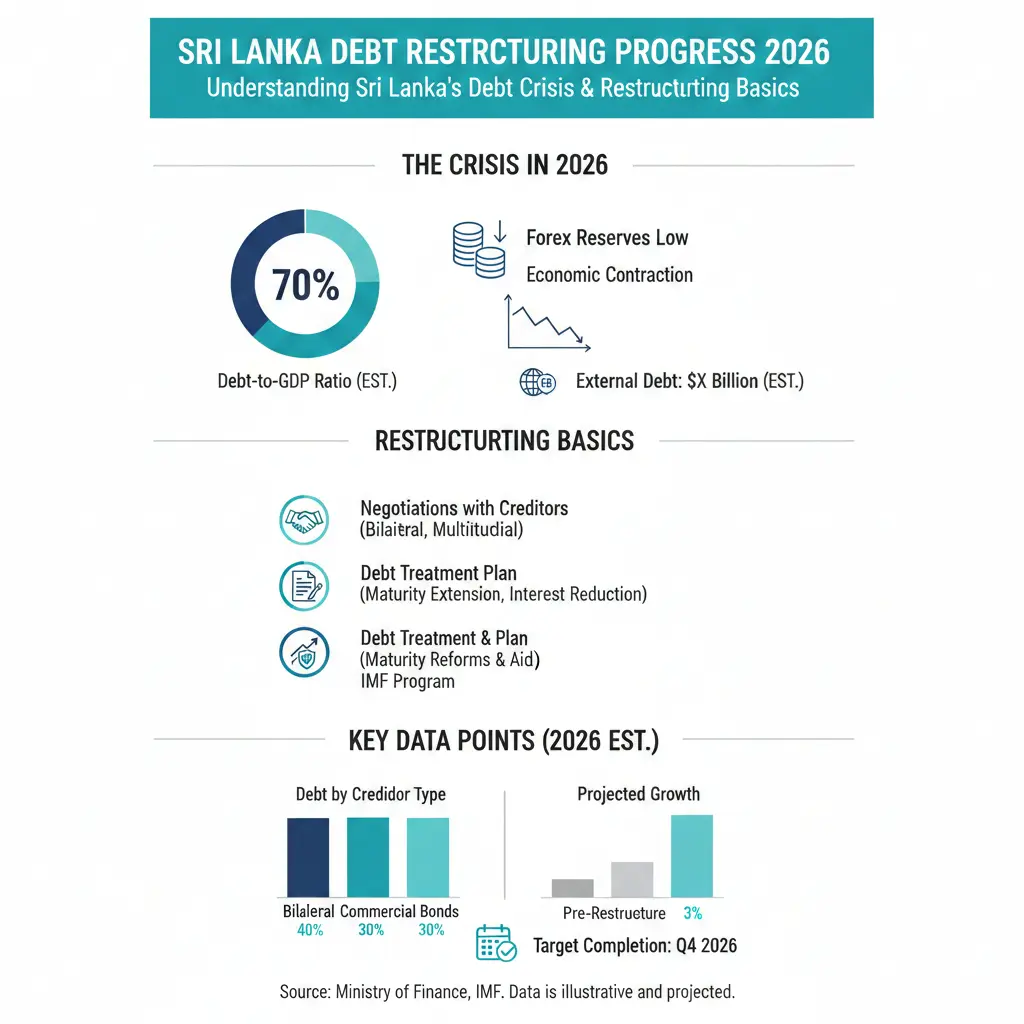

Understanding Sri Lanka's Debt Crisis and Restructuring Basics

Our debt woes peaked in April 2022 when Sri Lanka defaulted on external obligations for the first time since independence, triggered by loose fiscal policies and external shocks.[3] Reserves dwindled as we prioritised payments on International Sovereign Bonds (ISBs), exhausting foreign exchange buffers.[3]

The response? A comprehensive restructuring under the IMF's Extended Fund Facility (EFF), a US$2.9 billion programme spanning 2023-2026.[2][4] This involved domestic and external claims, navigating a diverse creditor landscape without G20 Common Framework eligibility.[3]

Key Milestones in the Restructuring Timeline

- 2022: Default declared; moratorium on foreign debt payments; advisors hired for negotiations.[3]

- 2023: EFF approval; initial agreements with bilateral creditors like Official Creditor Committee (OCC).[3]

- 2024-2025: Debt-to-GDP falls to 99.1% (gross) in 2024, projected 52.2% by 2025; 41% NPV reduction on restructured debt.[2]

- 2026 (as of February): Agreements with 99% of external creditors; 92%+ restructured; on track for IMF tranche.[1][6]

Recent briefings by Treasury Secretary Dr. Harshana Suriyapperuma to ISB holders confirm we're hitting IMF targets despite Cyclone Ditwah's US$4.1 billion damage, integrated into the 2026 Budget without fiscal slippage.[1]

2026 Progress: Where We Stand Today

By mid-2025, public debt dropped to 105% of GDP from 145% in 2022.[1] The Medium Term Debt Management Strategy (MTDS) 2026-2030 caps foreign currency debt service at 4.5% of GDP annually from 2027-2032, ensuring sustainability.[2]

Restructuring Achievements

We've locked in US$7.6 billion in restructured debt, with US$17 billion shaved off external service from 2023-2027.[5] Key moves include:

- Redenomination of foreign bonds to local currency with variable coupons for liquidity.[2]

- Macro-linked bonds (MLBs) tying payments to growth, even meeting targets if thresholds trigger.[5]

- External debt down from 69% of GDP in 2022 to projected 41.5% post-restructuring.[3]

These steps created fiscal space, redirecting funds to recovery amid shocks like the cyclone.[1][2]

IMF EFF Targets on Track

The EFF sets debt stock at 95% of GDP by 2032, gross financing needs (GFN) at 13% average (2027-2032), and FX service capped at 4.5% of GDP.[3] Sri Lanka's meeting these, with currency stabilisation, lower inflation, and rising reserves.[2]

Economic Implications for 2026 and Beyond

Debt restructuring isn't just numbers—it's reshaping our economy. Credit ratings upgraded in late 2024-2025 signal reduced default risk, boosting investor confidence.[2]

Positive Impacts on Everyday Life

- Fiscal Space: 41% NPV cut frees funds for health, education, and infrastructure.[2]

- Stability: Inflation tamed, rupee steadier, reserves bolstered—easing import costs for us locals.[2]

- Growth Momentum: Reforms under EFF drive revenue growth, cutting interest payments.[2][4]

Risks and Challenges Ahead

While progress is strong, cyclone recovery strains the 2026 Budget. Debt-to-GDP projections assume reform adherence; slippages could reverse gains.[1] Geopolitical creditor tensions add complexity.[7]

| Metric | 2022 Peak | 2025 (Actual/Projected) | 2032 Target |

|---|---|---|---|

| Public Debt-to-GDP | 145%[1] | 52.2-105%[1][2] | 95%[3] |

| External Debt-to-GDP | 69%[3] | 41.5%[3] | Declining[2] |

| FX Debt Service (% GDP) | High | Capped 4.5% (2027+)[2] | 4.5%[3] |

Practical Tips for Sri Lankans in 2026

As locals, understanding this helps you plan. Here's actionable advice:

For Households

- Monitor CBSL inflation reports at Central Bank site for borrowing decisions.

- Build emergency savings; restructuring stabilises but shocks like cyclones persist.

- Opt for fixed-rate loans if rates fall post-upgrades.

For Businesses and Investors

- Track Treasury updates on Treasury.gov.lk for bond opportunities.[2]

- Leverage MTDS 2026-2030 for investment horizons; lower service caps mean steadier growth.[2]

- Engage Export Development Board for FX-earning ventures to hedge risks.

Consult registered financial advisors via the Securities and Exchange Commission of Sri Lanka (SEC) for personalised plans.

FAQ: Common Questions on Sri Lanka Debt 2026

What percentage of Sri Lanka's external debt is restructured in 2026?

Over 92% restructured, with agreements covering 99% of creditors.[1][6]

Will debt restructuring affect my savings or loans?

Domestic restructuring protected banks in 2027, averting crisis; expect lower rates as stability improves.[2]

How does Cyclone Ditwah impact 2026 debt targets?

US$4.1 billion damage incorporated transparently into Budget, keeping IMF targets on track.[1]

When can we expect full debt sustainability?

IMF targets hit by 2032: 95% debt-to-GDP, with caps from 2027.[3]

Are credit rating upgrades real?

Yes, late 2024-2025 upgrades reflect reforms, aiding market access.[2]

What's next for IMF funding?

Next tranche imminent as restructuring completes.[1]

Next Steps for You and Our Economy

We've turned the corner—stay informed via official channels like Treasury and CBSL sites. Support reforms by paying taxes promptly and choosing local products to boost revenue. For investors, 2026 offers entry points with rising confidence. Together, we'll sustain this momentum towards a resilient future.

Sources & References

- Treasury Secy. briefs bondholders on debt progress — Themorning.lk — themorning.lk

- Medium Term Debt Management Strategy — Ministry of Finance (PDF) — treasury.gov.lk

- Sri Lanka's Sovereign Debt Restructuring: Lessons from Complex... (PDF) — IMF — imf.org

- Sri Lanka: Continued reform process and good economic momentum — Credendo — credendo.com

- SL briefs bondholders on US $7.6bn restructured debt — Daily Mirror — dailymirror.lk

- Sri Lanka tells ISB investors: Govt. locks in IMF targets — FT.lk — ft.lk

- How Sovereign Debt Crises Are Becoming Geopolitical — SAIS Review — saisreview.sais.jhu.edu

Related Articles

Sri Lanka IMF EFF Program 2026: Key Reforms and Impacts on Businesses

As we navigate 2026, Sri Lanka's IMF Extended Fund Facility (EFF) programme stands as a cornerstone of our economic revival, delivering vital funds and pushing through reforms that stabilise our finan...

How Sri Lanka's 2026 GDP Growth Forecast of 4-5% Affects Your Investments

Sri Lanka's economy is picking up speed, with the Central Bank forecasting a solid 4-5% GDP growth for 2026—good news for your savings, shares, and property investments.Sri Lanka GDP 2026 projections...

Sri Lanka Inflation Outlook 2026: Projections at 4.1% and Business Strategies

As we navigate 2026, Sri Lanka's inflation outlook points to a modest rise to around 4.1%, staying below the Central Bank's 5% target and paving the way for supportive monetary policies that benefit b...

Primary Surplus Targets in Sri Lanka 2026: IMF Compliance and Fiscal Impacts

Sri Lanka's commitment to maintaining a primary surplus of 2.3 percent of GDP through 2027 marks a critical turning point in the nation's fiscal recovery. This target, agreed with the International Mo...