Primary Surplus Targets in Sri Lanka 2026: IMF Compliance and Fiscal Impacts

Sri Lanka's commitment to maintaining a primary surplus of 2.3 percent of GDP through 2027 marks a critical turning point in the nation's fiscal recovery. This target, agreed with the International Mo...

Sri Lanka's commitment to maintaining a primary surplus of 2.3 percent of GDP through 2027 marks a critical turning point in the nation's fiscal recovery. This target, agreed with the International Monetary Fund under the Extended Fund Facility (EFF) programme, isn't just a number on a spreadsheet—it's the foundation for reducing our national debt, rebuilding economic resilience, and protecting vulnerable populations from future financial shocks.

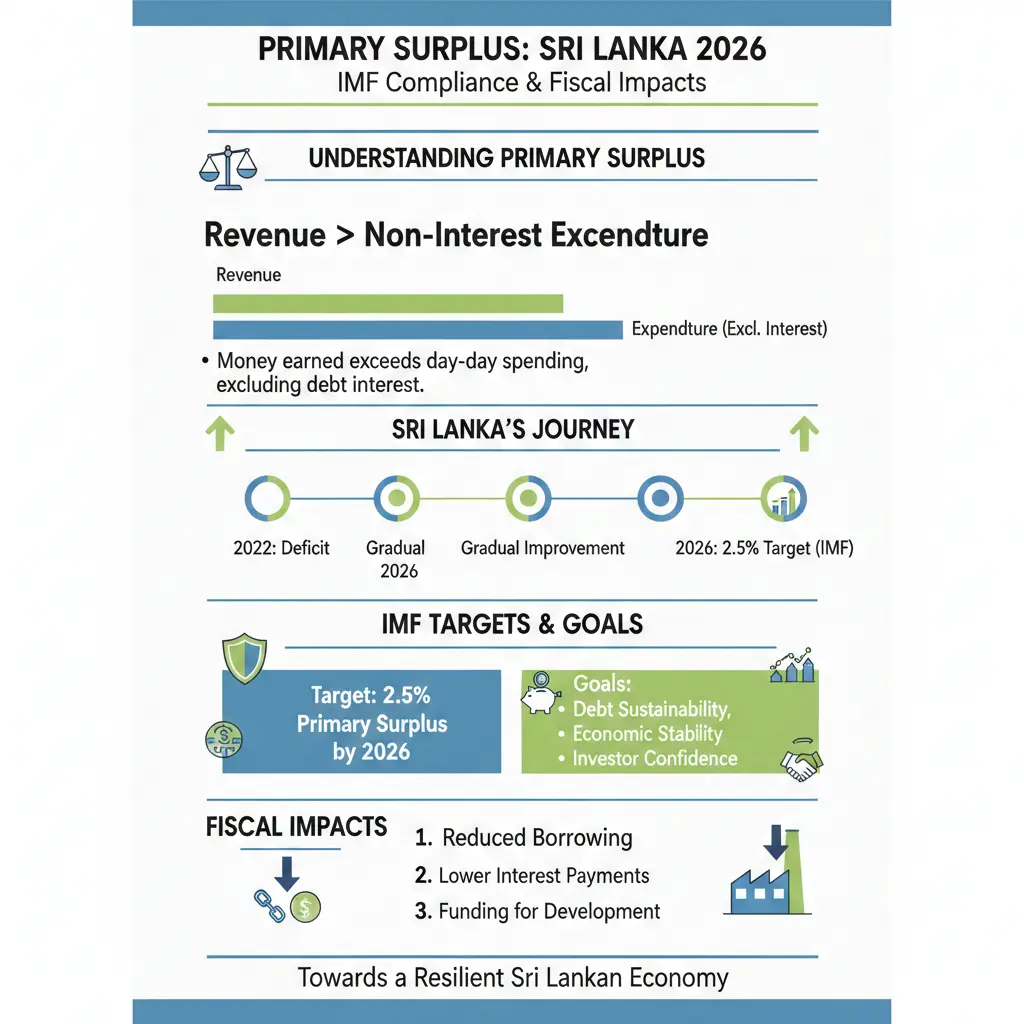

If you've been following Sri Lanka's economic news, you'll know we've faced significant challenges in recent years. The primary surplus target represents our government's commitment to spending less than it collects in revenue (excluding interest payments), a discipline that's essential for long-term stability. Let's explore what this means for you, your business, and our country's economic future.

Understanding Primary Surplus: What It Means for Sri Lanka

A primary surplus occurs when government revenue exceeds non-interest expenditure. Think of it like a household budget: if you earn Rs. 100,000 monthly and spend Rs. 97,000 on living expenses (excluding debt repayments), you've got a surplus of Rs. 3,000 to put towards paying down your mortgage. For Sri Lanka, this surplus is crucial because it allows us to reduce public debt without accumulating new borrowing.[1]

The 2.3 percent of GDP primary surplus target adopted for 2025-2027 represents a significant achievement. To put this in perspective, Sri Lanka's primary surplus in 2023 was only 0.6 percent of GDP.[2] The improvement reflects tighter fiscal discipline and better revenue collection—areas where we've made real progress under the IMF programme.

For the 2026 budget specifically, Parliament approved a primary expenditure allocation of 12.9 percent of GDP, with the government targeting a primary balance of 2.3 percent of GDP.[1] This means we're collecting enough revenue to not only fund government operations but also reduce our debt burden.

The 2026 Budget Framework: Balancing Growth and Stability

Revenue Targets and Expenditure Ceilings

The 2026 fiscal strategy projects government revenues at 15.2 percent of GDP, translating to a nominal primary expenditure ceiling of Rs. 4,470 billion.[2] These aren't arbitrary figures—they're calibrated to ensure we maintain the primary surplus while investing in critical infrastructure and protecting vulnerable populations.

Under the Public Financial Management Act (PFMA), primary expenditure is capped at 13 percent of GDP for the first five years, with the 2026 budget sitting at 12.9 percent.[2] This legislative ceiling provides a structural safeguard against overspending, ensuring that regardless of political pressures or unexpected events, we maintain fiscal discipline.

Performance Against Targets

How are we tracking? In the first four months of 2025, Sri Lanka achieved a primary surplus of Rs. 533 billion against a full-year target of Rs. 750 billion.[2] This puts us on course to meet our 2025 commitments, with all major tax revenue heads growing broadly in line with projections.

The 2025 primary balance is expected to reach 3.4 percent of GDP—even stronger than the 2.3 percent target—thanks partly to under-execution of capital expenditure (only 45 percent of the allocation was implemented by end-September).[1] Whilst this shows fiscal discipline, it also highlights an ongoing challenge: we need to improve capital expenditure execution to actually deliver infrastructure projects that boost productivity and growth.

Why 2.3 Percent? The IMF Programme and Debt Reduction

The specific 2.3 percent target isn't random. It's based on a Debt Sustainability Analysis (DSA) that determines the minimum primary surplus needed to reduce public debt to safer levels.[2] The goal is to eventually bring public debt below 60 percent of GDP—a level considered sustainable and resilient to external shocks.

Currently, Sri Lanka's debt remains elevated, and the margin for error is slim. If we experience major economic shocks (like Cyclone Ditwah in late 2025), we need fiscal buffers to respond without derailing our debt reduction trajectory. The primary surplus is that buffer.

The IMF approved emergency financing of US$206 million (SDR150.5 million) under the Rapid Financing Instrument in December 2025 to help Sri Lanka address immediate needs from the cyclone whilst maintaining the primary surplus target.[1] This support underscores the importance of our fiscal discipline—international creditors are more willing to help countries that demonstrate commitment to sustainable finances.

Cyclone Ditwah and the 2026 Supplementary Budget

The recent cyclone tested our fiscal framework. The government announced preliminary spending needs of around LKR500 billion (1.4 percent of GDP) for disaster relief, reconstruction, and supporting affected populations in 2026.[1] This creates a real challenge: how do we fund essential relief and rebuilding whilst maintaining our primary surplus target?

The authorities' solution involves preparing a Supplementary Budget that would reallocate existing expenditures and potentially increase the overall budget envelope, which would reduce the primary surplus slightly.[1] Additionally, the government intends to extend benefit periods under the Aswesuma cash transfer programme for vulnerable categories.[1]

This balancing act reflects a core principle: fiscal discipline doesn't mean ignoring human suffering. It means making tough choices about priorities, ensuring we help those affected whilst maintaining the long-term financial stability that protects everyone.

Revenue Enhancement: The Path to Sustainable Surpluses

Maintaining a 2.3 percent primary surplus requires more than just cutting expenditure—it requires growing revenues. The fiscal strategy targets lifting government revenues to above 15 percent of GDP over the medium term.[2]

This is where tax reforms become critical. Sri Lanka has been strengthening tax administration, broadening the tax base, and improving compliance. For businesses and individuals, this means:

- Enhanced tax collection and reduced opportunities for evasion

- Fairer distribution of the tax burden across the economy

- More sustainable funding for public services without constant borrowing

- Improved business confidence as fiscal stability strengthens

The government's commitment to revenue-based fiscal consolidation—growing revenues rather than just cutting spending—is more economically sustainable and less damaging to growth than expenditure-only austerity.

Economic Growth Implications

You might wonder: doesn't running a primary surplus slow economic growth? Not necessarily. Whilst the IMF revised the 2026 growth forecast to 2.9 percent due to the cyclone's impact, the Central Bank expects growth of 4.5 to 5 percent for 2025 and 2026.[3] This suggests that fiscal discipline and growth can coexist.

The key is how we spend. The fiscal strategy emphasises boosting investment in infrastructure and productive capacity.[2] When government spending shifts from current consumption to productive investment—roads, ports, renewable energy, education—it can support both fiscal sustainability and economic growth.

The 2026 budget includes efforts to improve capital expenditure execution, addressing the previous under-execution that saw only 45 percent of capital allocations spent.[1] Better execution means more infrastructure projects actually completed, delivering tangible benefits to communities and businesses.

What This Means for Different Groups

For Businesses

A government maintaining fiscal discipline signals stability. It means:

- Lower inflation risk (less money printing to cover deficits)

- More predictable interest rates and borrowing costs

- Stronger currency and better terms for international trade

- Government commitment to infrastructure investment benefiting commerce

For Workers and Households

Fiscal sustainability protects employment and incomes by:

- Preventing the economic crises that cause mass unemployment

- Maintaining funding for essential services (healthcare, education, utilities)

- Protecting vulnerable populations through targeted programmes like Aswesuma

- Enabling wage growth as the economy stabilises and grows

For Investors

The primary surplus target strengthens Sri Lanka's investment case by:

- Demonstrating commitment to IMF programme objectives

- Supporting debt reduction and improved credit ratings

- Building international reserves and external stability

- Reducing currency depreciation risk

Challenges and Risks to Watch

Maintaining the primary surplus target isn't straightforward. Several risks could derail progress:

External Shocks: The cyclone demonstrated how natural disasters can create urgent spending needs. Climate change means more frequent extreme weather events, requiring fiscal flexibility.

Revenue Volatility: Tax collections depend on economic growth, which can fluctuate. If growth slows more than expected, revenues will fall, making the surplus target harder to achieve.

Expenditure Pressures: Public sector wages, pensions, and social programmes create structural spending that's difficult to cut. Balancing these with fiscal targets requires careful management.

Political Economy: Maintaining discipline across multiple budget cycles and administrations is challenging. Future governments must uphold these commitments even when politically unpopular.

Frequently Asked Questions

Q: Why does Sri Lanka need a primary surplus when many developed countries run deficits?

A: Developed countries can sustain deficits because they have strong institutions, low borrowing costs, and reserve currencies. Sri Lanka, having recently faced a debt crisis, needs to rebuild credibility and reduce debt vulnerability. Once debt falls to safer levels (below 60 percent of GDP), we'll have more fiscal flexibility. For now, the surplus is essential medicine, not permanent policy.

Q: Will the primary surplus target be maintained if economic conditions worsen?

A: The government has indicated it may recalibrate targets if major shocks occur, but only if necessary to maintain the broader debt reduction objective.[2] The target isn't rigid dogma—it's a tool to achieve sustainability. However, abandoning it without cause would undermine credibility with international creditors and investors.

Q: How does the Supplementary Budget for cyclone relief affect the 2.3 percent target?

A: The supplementary budget will likely reduce the 2026 primary surplus below 2.3 percent, as relief spending increases the budget envelope.[1] However, this is acceptable because addressing humanitarian needs and rebuilding critical infrastructure serves the long-term objective of economic resilience. The government aims to revert to the 2.3 percent target in subsequent years.

Q: What happens if Sri Lanka misses the primary surplus target?

A: Missing the target would signal fiscal slippage and could trigger IMF programme reviews. It might require corrective measures—either additional revenue increases or expenditure cuts—to get back on track. Sustained non-compliance could jeopardise access to IMF support and damage investor confidence, leading to higher borrowing costs.

Q: Does the primary surplus mean government spending is being cut?

A: Not necessarily. The primary expenditure ceiling of 12.9 percent of GDP for 2026 is consistent with projected economic growth.[2] Real spending (adjusted for inflation) can grow, but at a slower pace than the overall economy. The focus is on efficiency and prioritisation—spending more on productive investments and less on wasteful expenditure.

Q: How long must Sri Lanka maintain the primary surplus target?

A: The current target of 2.3 percent runs through 2027, with the government committed to maintaining at least this level through 2030.[2] Beyond 2030, the target will depend on progress in debt reduction. Once debt reaches sustainable levels, the government will have more fiscal space. This is the light at the end of the tunnel—the surplus is temporary, but the stability it builds is permanent.

Looking Ahead: The Path to Fiscal Sustainability

Sri Lanka's primary surplus target represents more than fiscal policy—it's a commitment to stability, growth, and protecting our most vulnerable citizens. The 2.3 percent of GDP target for 2026 and beyond is calibrated to reduce public debt whilst maintaining space for essential investments and social support.

The recent cyclone tested this framework, but the government's response—combining relief spending with the supplementary budget—shows how fiscal discipline can be maintained whilst responding to genuine crises.

For those wanting to understand where our economy is headed, the primary surplus is a key indicator. When you see it maintained or exceeded, you can be confident that policymakers are prioritising long-term stability. When it slips, it's a signal to watch closely—not necessarily a cause for panic, but a sign that corrective action may be needed.

The goal is clear: reduce public debt to sustainable levels, rebuild our international reserves, and create an economy resilient enough to weather future shocks. We're on that path. Staying the course requires discipline from government, understanding from citizens, and patience from investors. But the destination—a fiscally sustainable Sri Lanka—is worth the effort.

Sources & References

- IMF Executive Board Approves US$206 Million in Emergency Financial Support for Sri Lanka — International Monetary Fund

- Fiscal Strategy Statement - 2026 — Parliament of Sri Lanka

- Sri Lanka tells ISB investors: Govt. locks in IMF targets, reforms — Financial Times Sri Lanka

- Sri Lanka's Budget Sticks to Fiscal Consolidation Path — Fitch Ratings

Related Articles

Sri Lanka IMF EFF Program 2026: Key Reforms and Impacts on Businesses

As we navigate 2026, Sri Lanka's IMF Extended Fund Facility (EFF) programme stands as a cornerstone of our economic revival, delivering vital funds and pushing through reforms that stabilise our finan...

How Sri Lanka's 2026 GDP Growth Forecast of 4-5% Affects Your Investments

Sri Lanka's economy is picking up speed, with the Central Bank forecasting a solid 4-5% GDP growth for 2026—good news for your savings, shares, and property investments.Sri Lanka GDP 2026 projections...

Sri Lanka Inflation Outlook 2026: Projections at 4.1% and Business Strategies

As we navigate 2026, Sri Lanka's inflation outlook points to a modest rise to around 4.1%, staying below the Central Bank's 5% target and paving the way for supportive monetary policies that benefit b...

Sri Lanka Foreign Reserves Update January 2026: Risks and Government Policy Responses

As we navigate 2026, Sri Lanka's foreign reserves have captured our attention with a slight dip in January, dipping to USD 6,824 million from USD 6,838 million the previous month.[1] This marginal dec...