Non-Resident Investment Policies Sri Lanka 2026: New Rules and How to Comply

Imagine turning your local business into a powerhouse by partnering with foreign investors, all while navigating Sri Lanka's updated rules for 2026. With FDI inflows projected to hit between US$1.5 bi...

Imagine turning your local business into a powerhouse by partnering with foreign investors, all while navigating Sri Lanka's updated rules for 2026. With FDI inflows projected to hit between US$1.5 billion and US$2 billion this year, non-resident investments offer exciting opportunities for us locals to grow our ventures amid economic recovery.[1]

Whether you're eyeing manufacturing expansions or tech partnerships, understanding the Sri Lanka FDI policy and non-resident investment rules is key. The Central Bank of Sri Lanka (CBSL) and Board of Investment (BOI) have prioritised clearer frameworks to attract quality capital, making compliance straightforward if you know where to start. This guide breaks down the new 2026 policies, compliance steps, and practical tips tailored for Sri Lankan entrepreneurs.

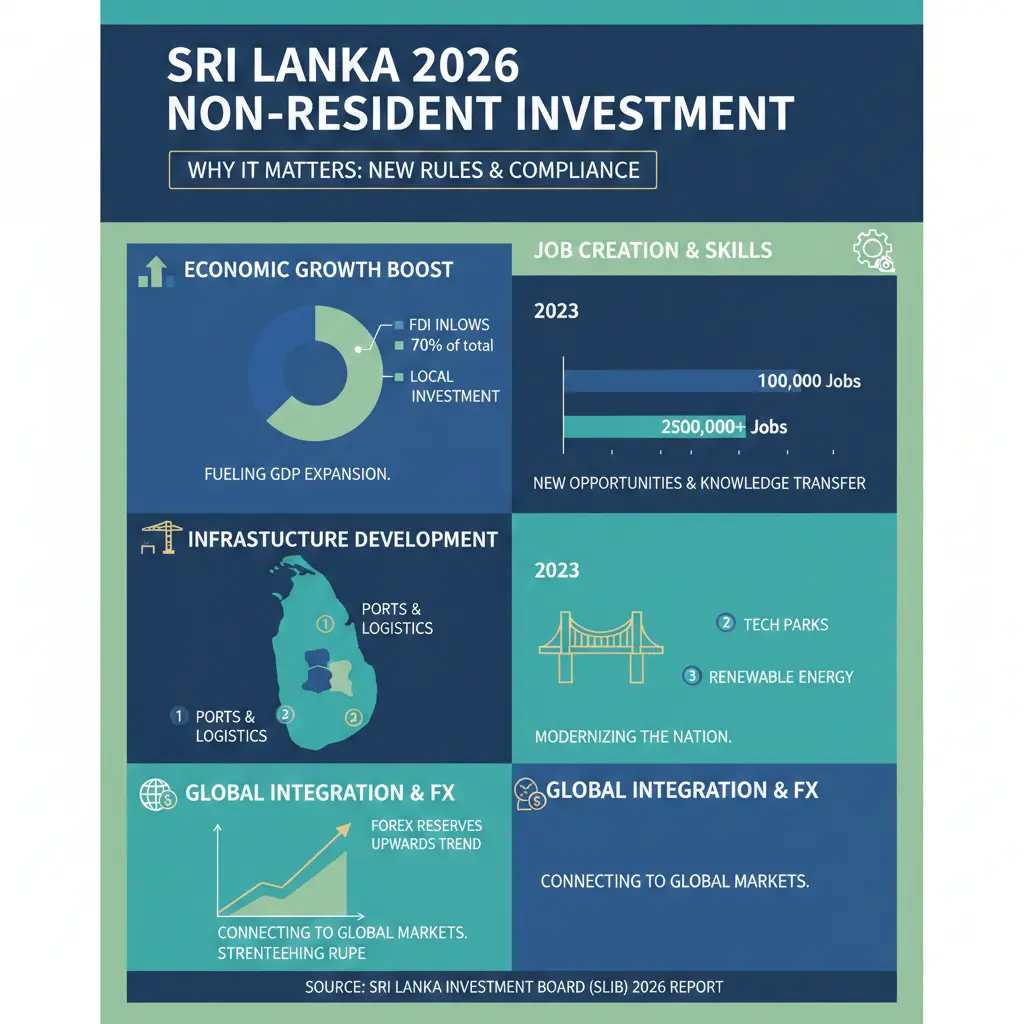

Why Non-Resident Investments Matter for Sri Lanka in 2026

Sri Lanka's economy is rebounding strongly, with FDI exceeding US$1 billion in 2025—a 72% jump from 2024.[4] This momentum carries into 2026, driven by macroeconomic stability and investor-friendly reforms. For locals, this means access to fresh capital for job creation, technology upgrades, and exports—especially in high-priority sectors like manufacturing and ports.

The BOI approved 146 projects worth US$1,906 million in 2025, with US$896 million as foreign capital, setting the stage for 2026 targets.[4] Realised FDI in early 2025 hit US$203 million in Q1 alone, up 90% year-on-year, with ports (41%), manufacturing (34%), and tourism (20%) leading.[3] Non-residents bring not just funds but expertise, helping us rebuild post-cyclone Ditwah and fuel 4-5% GDP growth.[1][2]

CBSL's Key Priorities for FDI in 2026

The CBSL's Policy Agenda for 2026 emphasises assessing investments in companies incorporated in Sri Lanka by non-resident investors and external commercial borrowings by residents.[2] This focuses on sustainable inflows, financial inclusion via tech, and robust resolution frameworks for distressed firms—aligning with global standards.

- Equity and reinvestments: Non-residents can inject capital into local firms, with 2025 seeing US$167 million in equity and US$213 million in reinvestments.[4]

- Intra-company loans and borrowings: US$567 million intra-company and US$110 million foreign commercial borrowings in 2025 show flexibility for expansions.[4]

- Sector focus: Manufacturing (46% of FDI), ports (26%), and tourism (11%) dominate, with greenfield projects like tyre manufacturing and dairy farming surging.[3][4]

New Rules in Sri Lanka's FDI Policy for 2026

2026 brings refined Sri Lanka FDI policy updates via BOI and CBSL, streamlining approvals while prioritising high-impact investments. No major overhauls, but enhanced monitoring and structured opportunities make it easier for non-residents to partner with locals.

BOI Approval Process Updates

All non-resident investments over certain thresholds require BOI clearance, especially for strategic sectors. In 2025, BOI received 79 proposals worth US$4,669 million (US$3,899 million foreign), approving 48 projects at US$499 million—creating 10,000 jobs.[3] For 2026:

- Submit proposals: Greenfield or expansions via BOI portal; expect evaluation by line agencies.

- Key sectors: Manufacturing, energy, real estate, agriculture (e.g., seaweed processing from Netherlands investors).[3]

- New initiative: 20 "Structured Investment Opportunities" launched for targeted promotion.[4]

Top source countries: Singapore, India, France, Netherlands, Luxembourg.[4] Locals benefit from 13% of 2025 FDI coming from new BOI-contracted projects (US$134 million).[4]

CBSL Regulations for Non-Resident Investments

CBSL oversees non-resident investment in local companies, ensuring exchange control compliance. Key 2026 rules:

- Non-residents can hold up to 100% equity in BOI-approved projects.

- Repatriation of profits/dividends allowed post-tax, via approved banks.

- External Commercial Borrowings (ECB) capped and monitored; residents need CBSL nod for large loans.[2]

- Tech-driven supervision: Digital reporting for faster approvals.[2]

"Key priorities for 2026 include assessing policies related to investments in companies incorporated in Sri Lanka by non-resident investors."[2]

How to Comply: Step-by-Step Guide for Locals

Compliance is simple with BOI's streamlined processes. Here's actionable advice for partnering with non-residents.

Step 1: Assess Your Project Fit

Check if your venture aligns with BOI priorities—manufacturing, ICT, agriculture. Use BOI's investor portal for eligibility. Example: A Colombo garment firm expanded with Indian FDI in 2025, boosting exports.[3]

Step 2: Prepare Documentation

- Business plan, financial projections, environmental impact (if applicable).

- Non-resident's KYC, source of funds proof.

- BOI application form—online submission takes 1-2 weeks initially.[3]

Step 3: Secure Approvals and Funding

Post-BOI nod, register with Companies Registrar and open an Inward Investment Account (IIA) at a commercial bank for FDI inflows. Track via CBSL's Exchange Control guidelines. Tip: Engage BOI's one-stop facilitation for faster clearance—reduced from months to weeks in 2025.[4]

Step 4: Ongoing Compliance

- Annual reporting to BOI on progress/employment.

- Tax filings: Enjoy BOI incentives like 5-10 year tax holidays for exports.

- Audit ECB if used; repatriate freely after compliance.[2]

Practical tip: For small-medium enterprises, start with joint ventures—locals hold majority for control, non-residents bring capital. Consult a lawyer familiar with BOI Act No. 4 of 1978 (as amended).

Sector-Specific Opportunities for Non-Resident Investments

Manufacturing and Exports

46% of 2025 FDI; ideal for locals in apparel or rubber. Example: Tyre/track projects from Czech Republic.[3][4]

Ports and Logistics

26% FDI share; expansions in Colombo Port create supplier opportunities for us.[4]

Tourism and Agriculture

Hotels, dairy, seafood—US$322 million expansions in 2025.[3]

FAQ

What’s the minimum FDI for BOI approval?

No strict minimum, but projects over US$1 million get priority; smaller ones via general approvals.[3]

Can non-residents buy land in Sri Lanka?

Limited to BOI-approved projects; condos ok for foreigners, but locals partner for commercial land.[3]

How long does BOI approval take in 2026?

4-8 weeks for complete applications, faster for structured opportunities.[4]

Are there tax breaks for FDI partnerships?

Yes, up to 10-year holidays for exports/manufacturing under BOI.[4]

What if my business uses ECB from non-residents?

CBSL approval needed; 2026 agenda strengthens monitoring.[2]

Who to contact for guidance?

BOI helpline or regional offices; CBSL for exchange queries.

Next Steps to Attract Non-Resident Investment

Ready to scale? Visit investsrilanka.com to pitch your idea, attend BOI investor forums, or network via delegations from India/China.[3] Partner smartly—FDI isn't just money; it's growth for our economy. With US$1.5-2 billion targeted, 2026 is your year to comply, invest, and thrive.[1] Start with a free BOI consultation today.

Sources & References

- Sri Lanka expects foreign investment to top 1.5 bln USD in 2026 — english.news.cn

- Central Bank's Policy Agenda for 2026 and Beyond (PDF) — cbsl.gov.lk

- Sri Lanka Sees Significant Surge in Foreign Direct Investments — investsrilanka.com

- BOI 2025 Numbers (PDF) — dgi.gov.lk

Related Articles

Sri Lanka IMF EFF Program 2026: Key Reforms and Impacts on Businesses

As we navigate 2026, Sri Lanka's IMF Extended Fund Facility (EFF) programme stands as a cornerstone of our economic revival, delivering vital funds and pushing through reforms that stabilise our finan...

How Sri Lanka's 2026 GDP Growth Forecast of 4-5% Affects Your Investments

Sri Lanka's economy is picking up speed, with the Central Bank forecasting a solid 4-5% GDP growth for 2026—good news for your savings, shares, and property investments.Sri Lanka GDP 2026 projections...

Sri Lanka Inflation Outlook 2026: Projections at 4.1% and Business Strategies

As we navigate 2026, Sri Lanka's inflation outlook points to a modest rise to around 4.1%, staying below the Central Bank's 5% target and paving the way for supportive monetary policies that benefit b...

Primary Surplus Targets in Sri Lanka 2026: IMF Compliance and Fiscal Impacts

Sri Lanka's commitment to maintaining a primary surplus of 2.3 percent of GDP through 2027 marks a critical turning point in the nation's fiscal recovery. This target, agreed with the International Mo...