Tax Deductions for Freelancers 2026

As a freelancer, you're likely no stranger to the financial complexities of running your own business. One of the most significant advantages of freelancing is the ability to claim tax deductions on your business expenses, which can help reduce your taxable income and lower your tax bill. You may b...

As a freelancer, you're likely no stranger to the financial complexities of running your own business. One of the most significant advantages of freelancing is the ability to claim tax deductions on your business expenses, which can help reduce your taxable income and lower your tax bill. You may be wondering what expenses qualify as tax deductions, how to keep track of them, and how to claim them on your tax return. By understanding the types of tax deductions available to freelancers, you can ensure you're taking advantage of all the deductions you're eligible for and keeping more of your hard-earned money.

In this article, you'll learn about the various types of tax deductions available to freelancers, including home office deductions, business expense deductions, travel and meal deductions, and health insurance and retirement deductions. You'll also discover how to properly track and record your expenses, and how to prepare for tax filing and potential audits. By the end of this article, you'll have a clear understanding of how to maximize your tax deductions and minimize your tax liability.

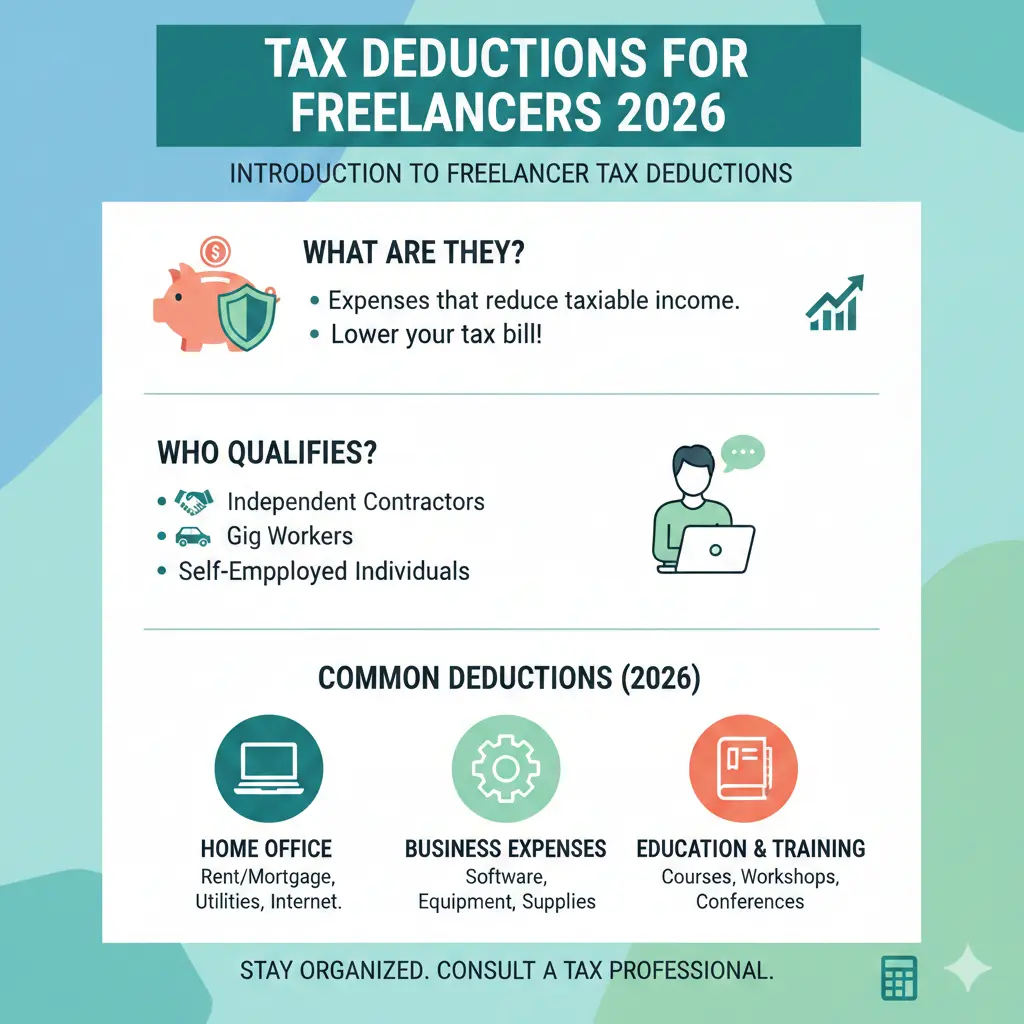

Introduction to Freelancer Tax Deductions

As a freelancer, you're considered self-employed and are required to report your income and expenses on your tax return. The good news is that you're eligible to claim tax deductions on your business expenses, which can help reduce your taxable income and lower your tax bill. There are several types of tax deductions available to freelancers, including home office deductions, business expense deductions, travel and meal deductions, and health insurance and retirement deductions. To take advantage of these deductions, it's essential to keep accurate records of your expenses throughout the year.

Record keeping is critical when it comes to tax deductions. You'll need to keep receipts, invoices, and bank statements to support your deductions in case of an audit. You can use a spreadsheet or accounting software to track your expenses and make it easier to categorize and total your deductions at tax time. For example, you can use a cloud-based accounting system like QuickBooks or Xero to track your expenses and generate reports to support your tax deductions.

It's also important to understand the difference between personal and business expenses. Personal expenses, such as groceries and entertainment, are not deductible, while business expenses, such as equipment and supplies, are deductible. You'll need to separate your personal and business expenses and only claim deductions for your business expenses. For instance, if you use your car for both personal and business purposes, you can only deduct the business use percentage of your car expenses.

Home Office Deductions for Freelancers

Home Office Deduction Methods

As a freelancer, you may be eligible to claim a home office deduction on your tax return. The home office deduction allows you to deduct a portion of your rent or mortgage interest and utilities as a business expense. There are two methods for calculating the home office deduction: the simplified option and the actual expenses method. The simplified option allows you to deduct $5 per square foot of home office space, up to a maximum of $1,500. The actual expenses method requires you to calculate your actual expenses, such as rent or mortgage interest, utilities, and insurance, and deduct them as a business expense.

For example, let's say you have a dedicated home office that's 200 square feet. Using the simplified option, you can deduct $1,000 (200 square feet x $5 per square foot). Alternatively, if you use the actual expenses method, you can deduct the actual expenses related to your home office, such as $1,200 in rent and $300 in utilities.

Home Office Expense Examples

Some examples of home office expenses that you can deduct include rent or mortgage interest, utilities, insurance, and repairs. You can also deduct the cost of equipment and supplies, such as a desk, chair, and computer. Additionally, you can deduct the cost of internet and phone services, as long as you use them for business purposes. For instance, if you pay $100 per month for internet service, you can deduct the business use percentage of that expense.

It's essential to keep accurate records of your home office expenses, including receipts and invoices, to support your deduction in case of an audit. You should also take photos of your home office space and keep a log of the hours you work from home to demonstrate that you use the space regularly for business purposes.

Business Expense Deductions for Freelancers

As a freelancer, you're eligible to deduct a wide range of business expenses on your tax return. Business expenses include any costs that are related to your business and are necessary for its operation. Some examples of business expenses that you can deduct include equipment and supplies, travel expenses, and professional fees. You can also deduct the cost of advertising and marketing, as well as the cost of education and training related to your business.

For example, if you're a freelance writer, you can deduct the cost of a computer, software, and printer as business expenses. You can also deduct the cost of attending writing conferences and workshops, as well as the cost of online courses or coaching services to improve your writing skills.

It's essential to keep accurate records of your business expenses, including receipts and invoices, to support your deductions in case of an audit. You can use a spreadsheet or accounting software to track your expenses and make it easier to categorize and total your deductions at tax time. For instance, you can use a cloud-based accounting system like QuickBooks or Xero to track your expenses and generate reports to support your tax deductions.

You should also consider using a business credit card or separate business bank account to keep your business expenses separate from your personal expenses. This will make it easier to track your business expenses and ensure that you're only deducting legitimate business expenses on your tax return.

Travel and Meal Deductions for Freelancers

As a freelancer, you may be eligible to deduct travel and meal expenses related to your business. Travel expenses include the cost of transportation, lodging, and meals while you're away from home on business. Meal expenses include the cost of food and beverages while you're traveling for business. However, there are some rules and limits to be aware of when it comes to travel and meal deductions.

For example, you can deduct the cost of transportation, such as flights, trains, or rental cars, as long as you're traveling for business purposes. You can also deduct the cost of lodging, such as hotel rooms or Airbnb rentals, as long as you're staying overnight for business purposes. However, you can only deduct 50% of your meal expenses, and you must keep receipts and records to support your deductions.

It's also important to note that you can only deduct meal expenses that are related to your business. For example, if you take a client out to dinner to discuss a project, you can deduct the cost of the meal as a business expense. However, if you're eating alone or with family or friends, the meal is not deductible as a business expense.

To maximize your travel and meal deductions, you should keep accurate records of your expenses, including receipts and invoices. You should also consider using a travel expense tracking app or spreadsheet to make it easier to categorize and total your deductions at tax time.

Health Insurance and Retirement Deductions for Freelancers

As a freelancer, you're responsible for providing your own health insurance and retirement benefits. However, you may be eligible to deduct the cost of these benefits on your tax return. For example, you can deduct the cost of health insurance premiums for yourself and your family as a business expense. You can also deduct the cost of retirement plan contributions, such as a SEP-IRA or solo 401(k), as a business expense.

Health Insurance Deduction Options

There are several health insurance deduction options available to freelancers, including the self-employed health insurance deduction. This deduction allows you to deduct the cost of health insurance premiums for yourself and your family as a business expense. You can also deduct the cost of other medical expenses, such as out-of-pocket medical expenses and long-term care insurance premiums.

Retirement Plan Deduction Benefits

Retirement plan deductions can provide significant tax benefits for freelancers. For example, you can deduct the cost of retirement plan contributions, such as a SEP-IRA or solo 401(k), as a business expense. You can also deduct the cost of administrative fees related to your retirement plan. Additionally, you may be eligible to deduct the cost of retirement plan contributions for your employees, if you have any.

For instance, if you contribute $10,000 to a SEP-IRA, you can deduct that amount as a business expense on your tax return. This can help reduce your taxable income and lower your tax bill. You should consult with a tax professional or financial advisor to determine the best retirement plan options for your business and to ensure you're taking advantage of all the deductions you're eligible for.

Tax Filing and Audit Preparation for Freelancers

As a freelancer, you're required to file your taxes annually, including your business income and expenses. You'll need to file Form 1040, which includes Schedule C, to report your business income and expenses. You may also need to file other forms, such as Form 1099-MISC, to report income from clients.

It's essential to keep accurate records of your business income and expenses, including receipts and invoices, to support your tax return in case of an audit. You should also consider hiring a tax professional or accountant to help you prepare your tax return and ensure you're taking advantage of all the deductions you're eligible for.

In addition to keeping accurate records, you should also be prepared for an audit by maintaining a separate business bank account and credit card, and by keeping detailed records of your business use of your car, home, and other assets. You should also consider setting aside funds for taxes and audits, in case you're required to pay additional taxes or penalties.

For example, you can set aside 25-30% of your income for federal income taxes, and 5-10% for state and local taxes. You should also consider setting aside an additional 10-20% for audit and penalty fees, in case you're audited and required to pay additional taxes or penalties.

Key Takeaways

In conclusion, tax deductions can provide significant benefits for freelancers, including reducing taxable income and lowering tax bills. By understanding the types of tax deductions available, including home office deductions, business expense deductions, travel and meal deductions, and health insurance and retirement deductions, you can ensure you're taking advantage of all the deductions you're eligible for. Remember to keep accurate records of your expenses, including receipts and invoices, to support your deductions in case of an audit.

As you prepare for tax season, take the time to review your expenses and ensure you're taking advantage of all the deductions you're eligible for. Consider hiring a tax professional or accountant to help you prepare your tax return and ensure you're in compliance with all tax laws and regulations. By being proactive and prepared, you can minimize your tax liability and keep more of your hard-earned money. What steps will you take today to maximize your tax deductions and reduce your tax bill?

Frequently Asked Questions

What is the deadline for filing taxes as a freelancer?

The deadline for filing taxes as a freelancer is typically April 15th of each year

Can I deduct business expenses on my tax return?

Yes, you can deduct business expenses on your tax return, but you must keep accurate records and follow IRS guidelines

Related Articles

How to Do Your Own Taxes 2026

Are you ready to take control of your finances and tackle your taxes like a pro? I think it's great that you're considering doing your own taxes this year. Not only can it save you money on preparation fees, but it also gives you a better understanding of your financial situation. You'll be able to...

Dow Jones Today Market Analysis

A staggering 70% of investors rely on the Dow Jones Industrial Average as a key indicator of the overall health of the US stock market. As you consider your investment strategy, understanding the intricacies of the Dow Jones can provide valuable insights into the market's trends and potential oppor...

Stock Market Basics for Beginners

As you consider investing in the stock market, you may have heard that it's a complex and intimidating world, best left to experienced professionals. However, with the right knowledge and guidance, you can make informed decisions and achieve your financial goals. You're about to discover the fundam...

Nvidia Stock Analysis 2026

As you consider investing in the tech industry, one company that consistently comes up is Nvidia. With its impressive track record of innovation and growth, it's no wonder that many investors are eager to get in on the action. But before you make a move, it's essential to take a closer look at Nvid...