Central Bank of Sri Lanka Policy Agenda 2026: Key Reforms for Businesses

As Sri Lankan businesses navigate recovery from Cyclone Ditwah and global uncertainties, the Central Bank of Sri Lanka's (CBSL) 2026 policy agenda offers a roadmap to stability. With the **Overnight P...

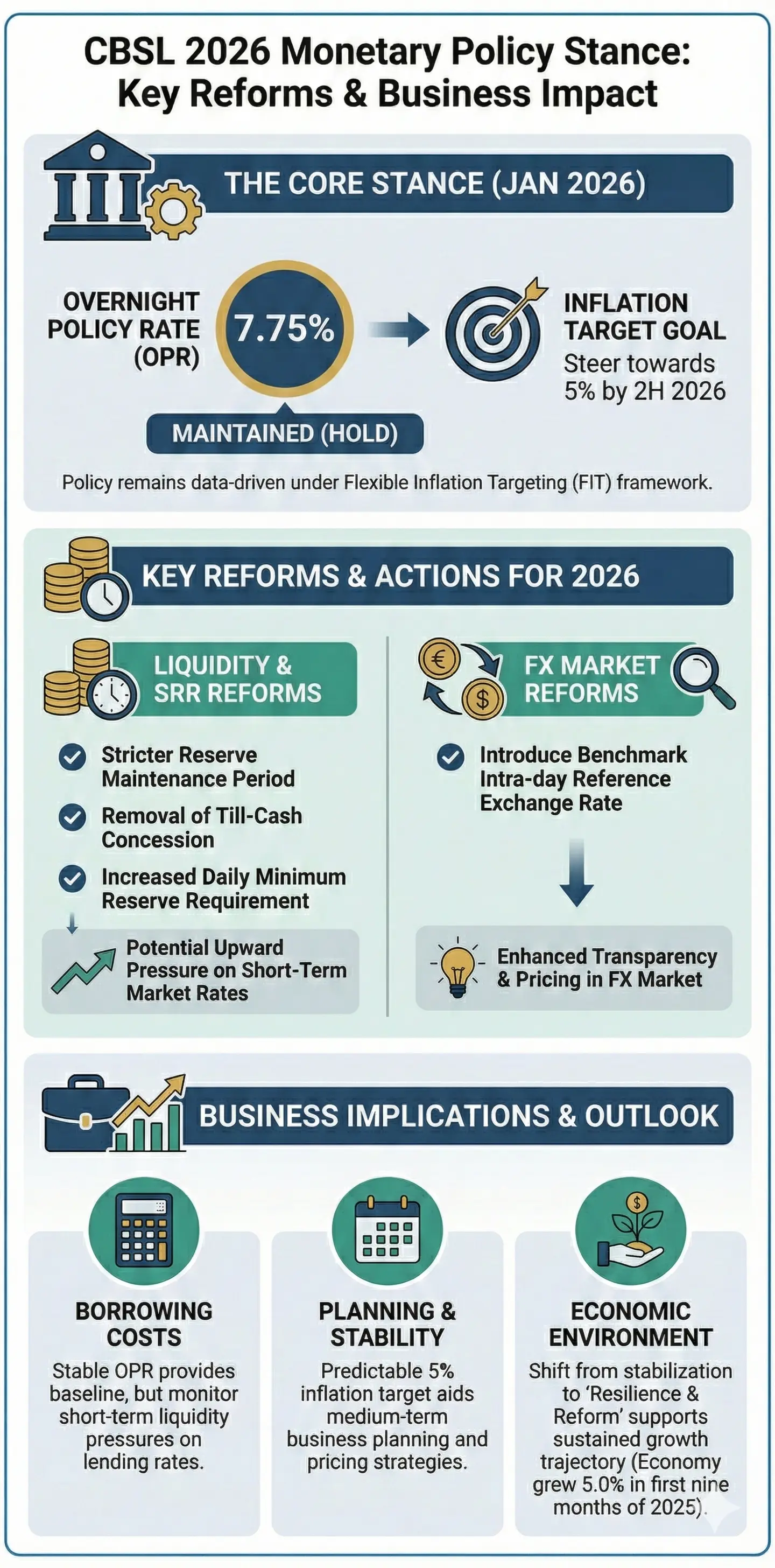

As Sri Lankan businesses navigate recovery from Cyclone Ditwah and global uncertainties, the Central Bank of Sri Lanka's (CBSL) 2026 policy agenda offers a roadmap to stability. With the **Overnight Policy Rate (OPR)** held steady at **7.75%**, CBSL signals confidence in steering inflation to its **5% target** while fostering growth—key intel for your business planning.[1][2]

Understanding CBSL's 2026 Monetary Policy Stance

CBSL's Monetary Policy Board kicked off 2026 by maintaining the OPR at 7.75% in its January review, balancing domestic resilience against external risks.[1] This decision reflects a cautiously accommodative approach, supporting credit growth amid post-cyclone rebuilding in areas like the Eastern Province.[2] For businesses, this means stable borrowing costs in the near term, but vigilance on inflation trends is essential.

Inflation Outlook: Path to the 5% Target

Headline inflation, measured by the Colombo Consumer Price Index (CCPI), stood at 2.1% in December 2025, ending an 11-month deflationary spell.[1][4] CBSL projects it will gradually accelerate to the 5% target by the second half of 2026, driven by strengthening demand and core inflation pressures.[2][4] Food prices rose due to Cyclone Ditwah's supply disruptions and festive demand, but expectations remain anchored.[1]

Upside risks include higher demand from credit expansion, rupee depreciation, adverse weather, or geopolitical tensions disrupting imports—critical for import-reliant businesses like retail and manufacturing.[2] Downside factors could be sustained low inflation or improved agriculture post-Ditwah.[2] Core inflation, stripping out volatile food and energy, is rising and expected to stabilise near 5%.[2][4]

Economic Growth and Credit Expansion

Sri Lanka's economy grew 5.0% in the first nine months of 2025, showing resilience despite Cyclone Ditwah.[2] Private sector credit surged in late 2025, fuelled by vehicle imports and reconstruction needs—expect this to continue into 2026.[2] CBSL's February Monetary Policy Report highlights leading indicators of sustained activity, though global headwinds pose threats.[4]

Key Reforms and Instruments Shaping 2026

Under the Central Bank of Sri Lanka Act, No. 16 of 2023, CBSL emphasises transparency via biannual Monetary Policy Reports, like the February 2026 release.[3][4] The policy framework targets price stability while supporting potential growth.

Policy Rates and Open Market Operations

The OPR at 7.75% anchors short-term rates, with open market operations fine-tuning liquidity.[1] Statutory Reserve Requirements remain a tool for credit control—businesses should monitor for adjustments in upcoming reviews.[6]

Exchange Rate and Reserves Stability

The rupee depreciated 5.6% against the USD in 2025 but stabilised early 2026.[2] Gross official reserves hit USD 6.8 billion by end-2025, bolstered by remittances, Central Bank purchases, and multilateral inflows.[2] A current account surplus persisted despite trade deficits—good news for exporters in apparel and tea sectors.

Practical Impacts on Sri Lankan Businesses

CBSL's stability-focused agenda means predictable costs, but businesses must adapt to gradual tightening if inflation heats up. Here's actionable advice tailored for our local context:

- Manage Borrowing Costs: With credit expanding, lock in loans now at current rates. Construction firms rebuilding after Ditwah can leverage this for equipment financing.

- Hedge Inflation Risks: Importers, watch food and energy prices. Diversify suppliers to mitigate cyclone-like disruptions.

- Capitalise on Growth: SMEs in tourism and agriculture can tap credit for expansion, as reserves support import needs.

- Monitor Reviews: Next meeting: 24 March 2026, announcement 25 March.[5] Full calendar on CBSL site helps plan cash flows.

Sector-Specific Opportunities

Agriculture and Food: Post-Ditwah recultivation could ease prices, but plan for weather risks. Government relief funds boost demand.[2]

Manufacturing and Exports: Stable rupee aids competitiveness; remittances sustain domestic demand.

SMEs: CBSL's inclusion push via the Stakeholder Engagement Committee encourages feedback—join consultations for policy input.[6]

Risks and Contingencies for 2026

CBSL flags global uncertainties, like Fed policies and geopolitics, alongside local factors like weather.[2][4] The Board stands ready to adjust, ensuring inflation stabilises at 5%.[1] Businesses: Build buffers with 3-6 months' reserves and scenario planning.

FAQ: CBSL Policy 2026 Essentials

What is the current Overnight Policy Rate? It's maintained at 7.75% as of January 2026.[1]

When will inflation hit the 5% target? Projected for the second half of 2026.[2][4]

How did Cyclone Ditwah affect the economy? It slowed late-2025 growth but spurred credit for rebuilding; resilience shown in early 2026 indicators.[2][4]

What's the next monetary policy announcement? 25 March 2026.[5]

Are reserves strong enough for imports? Yes, at USD 6.8 billion end-2025, supporting trade.[2]

Can businesses influence policy? Yes, through CBSL's Stakeholder Engagement Committee and public consultations.[6]

Next Steps for Your Business

Review CBSL's January Review and February Report today. Track the advance release calendar, diversify risks, and optimise credit use. Stay ahead—stable policies like these reward prepared businesses. Visit CBSL's site for updates, and consult Lanka Websites for tailored digital strategies to thrive in 2026.

Sources & References

- Monetary Policy Review No. 1 of 2026 — cbsl.gov.lk

- Monetary Policy Review No. 1 of 2026 (PDF) — cbsl.gov.lk

- Central Bank of Sri Lanka Official Website — Monetary Policy Report Announcement — cbsl.gov.lk

- Monetary Policy Report – February 2026 (PDF) — cbsl.gov.lk

- Monetary Policy Advance Release Calendar 2026 — cbsl.gov.lk

- CBSL Releases Monetary Policy Report – February 2026 — cbsl.gov.lk