Cryptocurrency Explained for Beginners

As you consider entering the world of cryptocurrency, you're likely to encounter a plethora of unfamiliar terms, complex concepts, and conflicting opinions. You may wonder if this new financial frontier is right for you, and how you can avoid common pitfalls. As an industry insider, I'm here to sha...

As you consider entering the world of cryptocurrency, you're likely to encounter a plethora of unfamiliar terms, complex concepts, and conflicting opinions. You may wonder if this new financial frontier is right for you, and how you can avoid common pitfalls. As an industry insider, I'm here to share my knowledge and provide you with a clear understanding of the cryptocurrency market, its underlying technology, and the opportunities it presents. By the end of this article, you'll have a solid foundation in cryptocurrency and be well-equipped to make informed decisions about your involvement in this exciting and rapidly evolving space.

You'll learn about the history and definition of cryptocurrency, how blockchain technology works, and the different types of cryptocurrencies available. You'll also gain insight into the processes of mining and trading, as well as the security measures in place to protect your investments. Whether you're looking to invest, trade, or simply learn more about this innovative technology, you'll find valuable information and practical advice to help you achieve your goals.

Introduction to Cryptocurrency

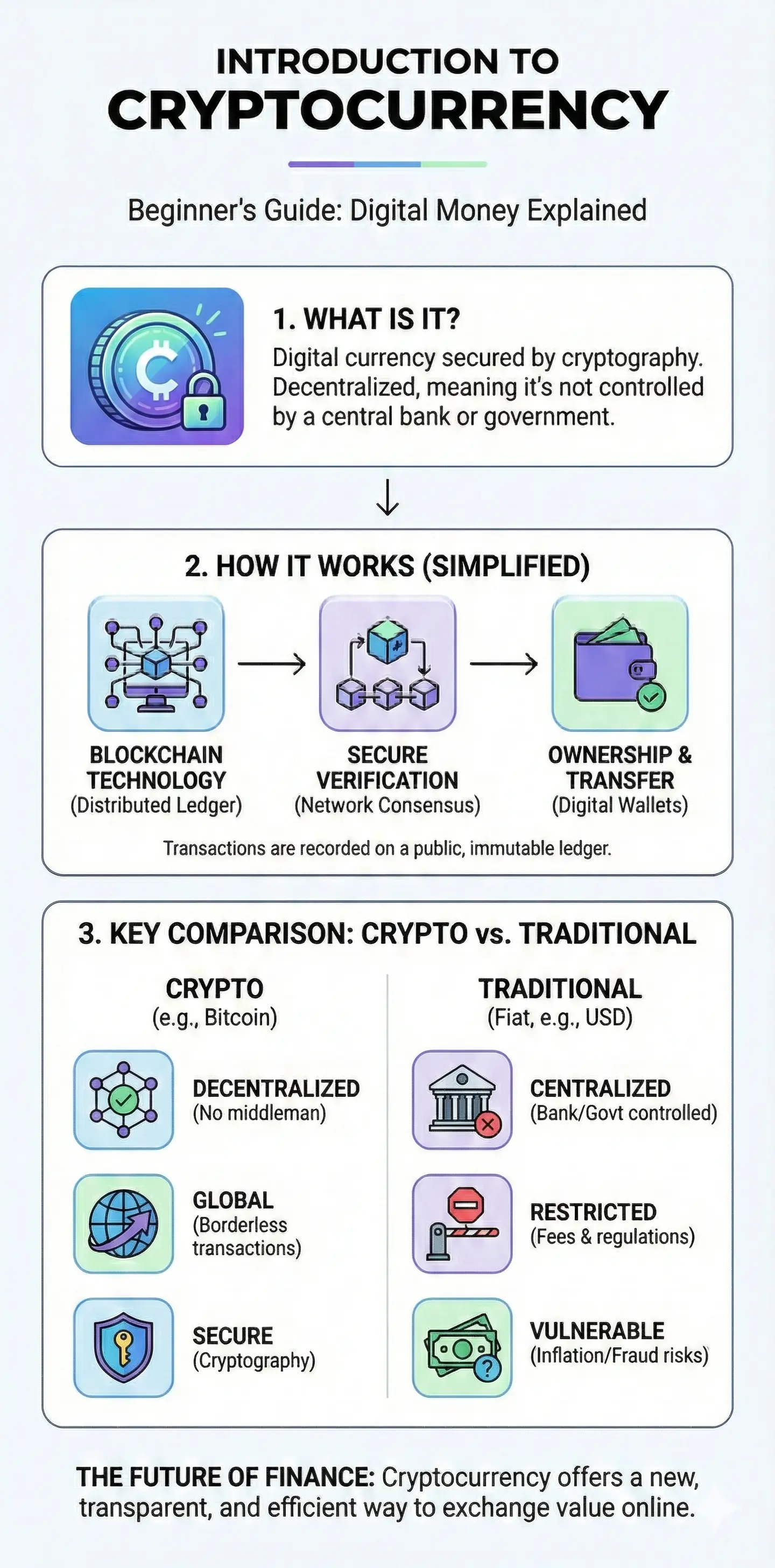

Cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it's not controlled by any government or financial institution. The concept of cryptocurrency has been around since the 1980s, but it wasn't until the launch of Bitcoin in 2009 that it gained widespread attention. Since then, hundreds of alternative cryptocurrencies, known as altcoins, have been developed, each with its own unique features and purposes.

The history of cryptocurrency is marked by periods of rapid growth and sharp declines, but overall, it has continued to gain traction and acceptance. One of the key factors contributing to its success is the transparency and security provided by blockchain technology, which records all transactions made with a particular cryptocurrency. This ledger is maintained by a network of computers around the world, rather than a central authority, making it virtually impossible to alter or manipulate.

There are several types of cryptocurrencies, including payment currencies, such as Bitcoin, and utility tokens, which are used to access specific products or services. Some cryptocurrencies, like Ethereum, have their own programming languages and are used to create smart contracts and decentralized applications. As you explore the world of cryptocurrency, it's essential to understand the different types and their uses, as well as the benefits and risks associated with each.

For example, Bitcoin is widely considered the most stable and secure cryptocurrency, while Ethereum is known for its versatility and potential for innovation. Other cryptocurrencies, such as Litecoin and Monero, offer faster transaction times and greater anonymity, respectively. As you consider investing in or using cryptocurrency, it's essential to research and understand the unique characteristics of each.

How Blockchain Technology Works

Blockchain Basics

Blockchain technology is the foundation of cryptocurrency, and it's what sets it apart from traditional fiat currencies. A blockchain is a distributed ledger that records all transactions made with a particular cryptocurrency. This ledger is maintained by a network of computers around the world, rather than a central authority, making it virtually impossible to alter or manipulate. Each block in the chain contains a list of transactions, and once a block is added to the chain, the information it contains can't be altered.

The process of adding new blocks to the chain is called mining, and it's performed by powerful computers that solve complex mathematical problems. The first computer to solve the problem gets to add a new block to the chain and is rewarded with a certain amount of cryptocurrency. This process not only helps to secure the network but also verifies the transactions and ensures that the same cryptocurrency isn't spent twice.

Security

One of the most significant advantages of blockchain technology is its security. The decentralized nature of the ledger, combined with the use of advanced cryptography, makes it virtually impossible for hackers to alter or manipulate the data. Additionally, the transparency of the blockchain allows all users to see the entire history of transactions, making it easier to detect and prevent fraudulent activity.

For instance, the use of public-key cryptography ensures that only the owner of a particular address can spend the associated cryptocurrency. Furthermore, the decentralized nature of the blockchain means that there is no single point of failure, making it more resistant to attacks and downtime.

Types of Cryptocurrencies and Their Uses

There are over 5,000 different cryptocurrencies in existence, each with its own unique features and purposes. Bitcoin is the most well-known and widely used cryptocurrency, and it's often referred to as the "gold standard" of cryptocurrency. It's primarily used as a store of value and a medium of exchange, and its price is often seen as a benchmark for the overall cryptocurrency market.

Ethereum, on the other hand, is a more versatile cryptocurrency that has its own programming language and is used to create smart contracts and decentralized applications. It's often referred to as the "world computer" because of its ability to execute complex scripts and protocols. Other notable cryptocurrencies include Ripple, which is focused on cross-border payments, and Monero, which is known for its privacy and anonymity features.

Altcoins, or alternative cryptocurrencies, are any cryptocurrencies that are not Bitcoin. They often have unique features and uses, and some have gained significant traction and popularity. For example, Litecoin is a faster and more lightweight version of Bitcoin, while Dogecoin is a cryptocurrency that was created as a joke but has since gained a significant following and is often used for charitable donations.

When considering investing in or using a particular cryptocurrency, it's essential to research and understand its unique features, uses, and potential risks. You should also be aware of the current market trends and the potential for price volatility. By doing your due diligence and staying informed, you can make more informed decisions and avoid common pitfalls.

Cryptocurrency Mining and Trading

Mining Process

Cryptocurrency mining is the process of verifying transactions and adding new blocks to the blockchain. It's a complex and energy-intensive process that requires powerful computers and specialized software. Miners compete to solve complex mathematical problems, and the first one to solve the problem gets to add a new block to the chain and is rewarded with a certain amount of cryptocurrency.

The mining process is not only essential for the security and integrity of the blockchain but also for the creation of new cryptocurrency. The reward for mining is designed to incentivize miners to continue to verify transactions and maintain the security of the network. However, the mining process can be highly competitive, and the energy requirements can be significant, which has led to concerns about the environmental impact of cryptocurrency mining.

Trading Platforms

Cryptocurrency trading involves buying and selling cryptocurrency on online exchanges. These exchanges allow users to trade one cryptocurrency for another or for fiat currencies like the US dollar. There are many different trading platforms available, each with its own fees, features, and security measures.

Some popular trading platforms include Coinbase, Binance, and Kraken. When choosing a trading platform, it's essential to consider factors such as security, fees, and liquidity. You should also be aware of the risks associated with trading cryptocurrency, including price volatility and the potential for market manipulation.

For example, stop-loss orders can help limit your losses in the event of a price drop, while position sizing can help you manage your risk and avoid over-leveraging your account. By understanding the risks and using the right strategies, you can trade cryptocurrency more effectively and achieve your financial goals.

Security and Future of Cryptocurrency

Security is a top concern for anyone involved in cryptocurrency. The decentralized nature of the blockchain and the use of advanced cryptography make it difficult for hackers to alter or manipulate the data. However, there are still risks associated with cryptocurrency, including the potential for exchange hacks, wallet theft, and phishing scams.

To protect yourself, it's essential to use strong passwords, enable two-factor authentication, and keep your software and wallets up to date. You should also be aware of the potential risks associated with investing in cryptocurrency, including price volatility and the potential for market manipulation.

Looking to the future, cryptocurrency is likely to continue to play a significant role in the financial landscape. As more businesses and individuals begin to use and accept cryptocurrency, its value and adoption are likely to increase. Additionally, the development of new technologies, such as quantum computing, may have a significant impact on the security and efficiency of cryptocurrency.

For instance, the use of multi-signature wallets can provide an additional layer of security, while cold storage can help protect your cryptocurrency from hacking and theft. By staying informed and taking the necessary precautions, you can help ensure the security and integrity of your cryptocurrency investments.

Regulations are also likely to play a significant role in the future of cryptocurrency. As governments and regulatory bodies begin to take a closer look at cryptocurrency, we can expect to see more clear guidelines and regulations. This may help to increase adoption and legitimacy, but it may also pose challenges for some cryptocurrency projects and users.

Key Takeaways

In conclusion, cryptocurrency is a complex and rapidly evolving field that offers a wide range of opportunities and challenges. By understanding the basics of cryptocurrency, blockchain technology, and the different types of cryptocurrencies, you can make more informed decisions and avoid common pitfalls. Remember to always prioritize security, stay informed, and be aware of the potential risks and rewards associated with cryptocurrency.

As you consider your next steps, ask yourself: what role do you want cryptocurrency to play in your financial future? Will you be an investor, a trader, or simply a user of cryptocurrency? Whatever your goals, it's essential to stay informed, adapt to changing circumstances, and always prioritize security and caution. By doing so, you can help ensure a successful and profitable experience in the world of cryptocurrency.

Frequently Asked Questions

What is cryptocurrency?

A digital or virtual currency that uses cryptography for security

How does blockchain work?

A decentralized ledger that records transactions across a network of computers

Related Articles

Best Credit Cards for 2026

Are you tired of using a credit card that doesn't quite meet your needs? You're not alone. With so many options available, it can be overwhelming to choose the right one. But what if you could find a credit card that offers the perfect combination of rewards, benefits, and terms? I think it's time...

Financial Planning for Young Professionals

As a young professional, you're likely no stranger to hard work and dedication. You've spent years studying, interning, and building your skills to land your dream job. But have you stopped to think about what you're working towards? I think it's easy to get caught up in the daily grind and forget...

How to Build an Emergency Fund

Imagine having a financial safety net that protects you from life's unexpected expenses, allowing you to breathe a sigh of relief when your car breaks down or you lose your job. Having an emergency fund in place can be a lifesaver, reducing financial stress and giving you peace of mind. You may be...

Best Index Funds 2026

As you consider your investment options for 2026, you may be wondering which index funds are the best choice for your portfolio. With so many options available, it can be overwhelming to decide which funds to invest in. You may have heard that index funds are a low-risk, low-cost way to invest in...